New York Essential Plan: Free Health Insurance in NY

The New York Essential Plan offers free health insurance for eligible New Yorkers, covering medical, dental, vision, and more. NY Health Insurer’s licensed brokers simplify enrollment—call (888) 215-4045 for a free quote.

What Is the New York Essential Plan?

The New York Essential Plan is a state-sponsored health insurance program designed for residents who don’t qualify for Medicaid but need affordable coverage. Administered through NY State of Health (NYSOH), it provides comprehensive healthcare with $0 premiums, no deductibles, and low or no copays for services like doctor visits and prescriptions. Launched in 2016 as part of the Affordable Care Act (ACA), the program has enrolled over 1.5 million New Yorkers as of 2025, with eligibility expanded to 250% of the Federal Poverty Level (FPL) in 2024.

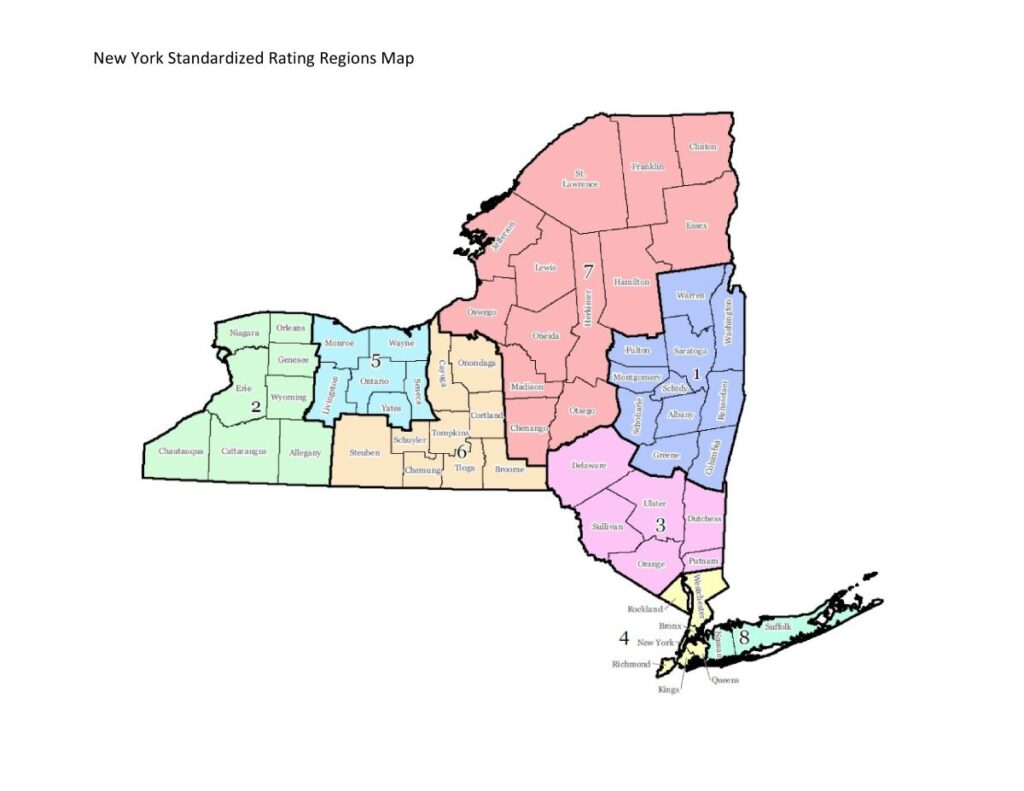

NY Health Insurer, a trusted broker since 2013, streamlines the enrollment process with instant plan comparisons and personalized, multilingual support. Available across every New York county, from urban centers like Manhattan to rural areas like the Adirondacks, the Essential Plan is offered by trusted insurers such as Healthfirst, Fidelis Care, UnitedHealthcare, and MetroPlus Health. Each insurer provides unique benefits, including telehealth services, gym membership reimbursements, and community wellness programs, tailored to diverse needs.

The Essential Plan is ideal for low-income adults aged 19–64, including eligible immigrants like DACA recipients, who seek comprehensive coverage without high costs. Unlike Qualified Health Plans (QHPs), which cater to higher incomes, or Medicaid, which has stricter income limits, the Essential Plan bridges the gap for working New Yorkers. Its year-round enrollment makes it accessible anytime, unlike QHPs’ limited open enrollment periods.

For a broader overview of NYSOH programs, visit our NY State of Health guide, or explore related options like Qualified Health Plans or Child Health Plus.

Why Choose the New York Essential Plan?

The Essential Plan is a standout choice for affordable, high-quality healthcare in New York. Here’s why it’s a top option for eligible residents:

- Free or Low-Cost Coverage: $0 premiums up to 250% FPL, with no deductibles, making healthcare accessible without financial strain.

- Comprehensive Benefits: Covers all ACA-required essential health benefits, including medical care, dental, vision, mental health services, and preventive care, ensuring holistic support.

- Statewide Availability: Available in every county, with urban-focused perks in NYC (e.g., telehealth) and community-driven programs Upstate (e.g., wellness workshops).

- Inclusive Eligibility: Open to U.S. citizens, permanent residents, and eligible immigrants, including DACA recipients, supporting New York’s diverse communities.

- Expert Broker Support: NY Health Insurer’s licensed brokers provide free, multilingual guidance, helping you compare plans and enroll seamlessly.

- Year-Round Enrollment: Unlike QHPs, you can enroll anytime, offering flexibility for life changes like job transitions or moves.

In 2024, a Bronx resident we assisted enrolled in the Essential Plan for $0 premiums, saving $2,000 annually while accessing telehealth services. Another client in Albany switched from a costly private plan to the Essential Plan, cutting expenses by $1,800 with added dental coverage. These stories highlight the plan’s value for New Yorkers seeking affordable, comprehensive healthcare.

Ready to find out if the Essential Plan is right for you? Our brokers at NY Health Insurer are here to guide you through every step, ensuring you get the coverage you need without breaking the bank. Start your journey to affordable health insurance today.

Essential Plan Benefits: Comprehensive Coverage

The Essential Plan delivers robust coverage designed to keep you healthy without financial burden. Below is a detailed breakdown of the benefits you can expect, ensuring you have access to the care you need when you need it:

- Medical Care: Includes primary care visits, specialist consultations, hospital stays, emergency services, and preventive care such as annual checkups, vaccinations, and cancer screenings. Most services have $0 copays, making routine care affordable.

- Prescriptions: Covers generic medications at $0 copay and brand-name drugs at $3–$6 copay, depending on the insurer, ensuring access to necessary treatments without high costs.

- Dental Care: Provides two cleanings per year, exams, X-rays, fillings, and, in some plans, advanced procedures like root canals with minimal copays, supporting oral health for all enrollees.

- Vision Care: Offers annual eye exams and up to $100 for glasses or contact lenses, helping maintain eye health and vision correction.

- Mental Health Services: Includes therapy, counseling, and psychiatric care with low or no copays, addressing emotional and mental well-being, which is increasingly vital for New Yorkers.

- Additional Perks:

- Telehealth: 24/7 virtual doctor visits for non-emergency issues like colds, allergies, or minor injuries. For example, Healthfirst provides seamless telehealth access, ideal for busy urban residents.

- Gym Reimbursements: Up to $100 annually for gym memberships or fitness classes through insurers like UnitedHealthcare, encouraging a healthy lifestyle.

- Community Wellness Programs: Free resources like diabetes supplies (e.g., glucose monitors) and local health workshops from Fidelis Care, supporting chronic condition management.

- Maternity and Newborn Care: Comprehensive prenatal, delivery, and postnatal care, ensuring support for expecting parents.

The Essential Plan’s benefits are tailored to meet the diverse needs of New Yorkers, from young professionals in NYC to retirees in Upstate communities. For instance, a Brooklyn mother we assisted in 2024 used Healthfirst’s telehealth to manage her child’s allergies without leaving home, saving time and money. Similarly, a Syracuse resident accessed Fidelis Care’s free diabetes supplies, improving their quality of life without additional costs.

To explore specific insurer benefits, check out our guides for Healthfirst, Fidelis Care, or UnitedHealthcare. These resources provide in-depth details on each provider’s offerings, helping you choose the plan that best fits your lifestyle.

Essential Plan vs. Other NYSOH Programs

The Essential Plan is a unique option for low-income adults, but how does it compare to other NYSOH programs like Medicaid, Qualified Health Plans (QHPs), or Child Health Plus? Here’s a detailed comparison to help you decide:

| Criteria | Essential Plan | Medicaid | Qualified Health Plans | Child Health Plus |

|---|---|---|---|---|

| Cost | $0, no deductibles | $0, minimal copays | Varies, subsidies available | $0–$60/month |

| Eligibility | 138%–250% FPL (e.g., $37,650 single) | Up to 138% FPL | No income limit | Up to 400% FPL |

| Benefits | Medical, dental, vision, telehealth | Medical, limited dental/vision | Varies, often excludes dental/vision | Medical, dental, vision |

| Enrollment | Year-round | Year-round | Nov 1–Jan 31 or special periods | Year-round |

| Best For | Low-income adults | Very low-income individuals | Flexible provider needs | Children under 19 |

In 2024, a Syracuse resident we helped chose the Essential Plan over a QHP, saving $1,500 annually with dental and vision coverage. A Queens family opted for Child Health Plus for their kids and the Essential Plan for themselves, saving $2,000 combined. These examples show the plan’s value for adults' ineligible for Medicaid but needing comprehensive care.

For a deeper comparison, compare with Medicaid in our Essential Plan vs. Medicaid guide, or explore Child Health Plus for family coverage options.

Who Qualifies for the Essential Plan?

The Essential Plan is designed for low-income New Yorkers who meet specific criteria. To be eligible, you must:

- Reside in New York State: Available in all counties, from NYC to rural Upstate areas.

- Be Aged 19–64: Covers adults not eligible for Child Health Plus or Medicare.

- Have Income Between 138%–250% FPL: For 2025, this translates to $21,597-$39,125 for a single adult, $29,187–$52,875 for a couple, or $44,367–$80,375 for a family of 4. Note: FPL limits may adjust slightly with inflation.

- Meet Immigration Requirements: U.S. citizens, permanent residents, or eligible immigrants, including DACA recipients, qualify.

- Not Be Enrolled in Medicaid or Medicare: Ensures the plan targets those without other public coverage.

Explore medical insurance options in NY based on your life stage—whether you're turning 26, starting a family, or retiring early, there’s a plan that fits your needs.

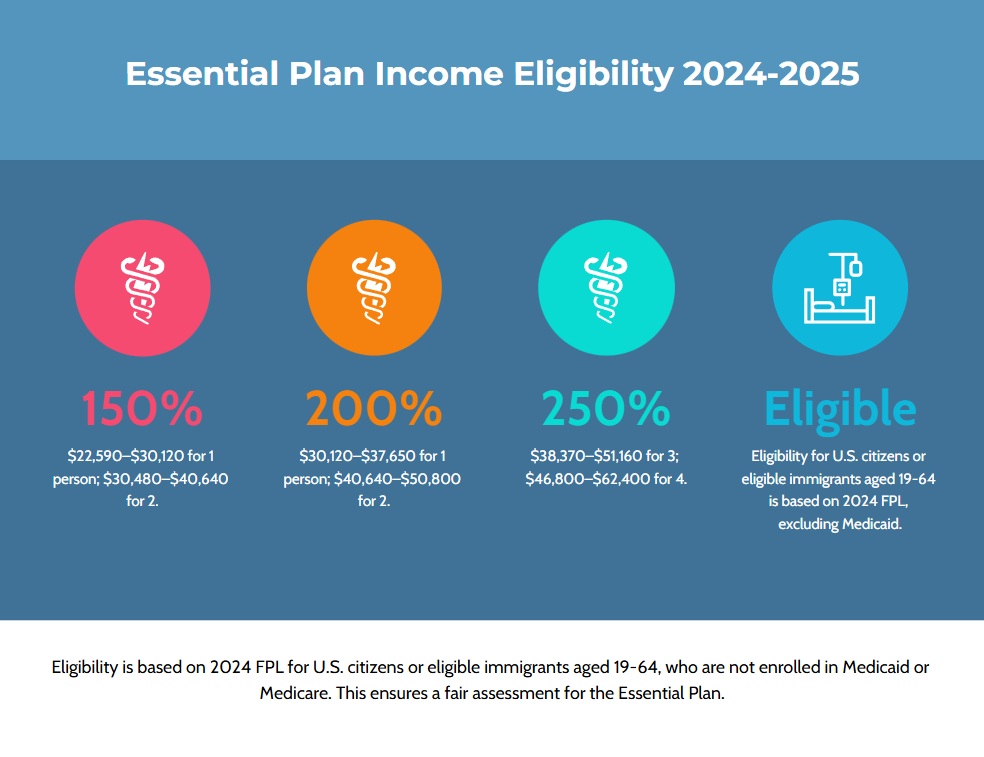

Here’s a detailed 2025 income eligibility table for the Essential Plan:

| Household Size | Income Range (138%–250% FPL) | Monthly Premium |

|---|---|---|

| 1 | $21,597–$39,125 | $0 |

| 2 | $29,187–$52,875 | $0 |

| 3 | $36,777–$66,625 | $0 |

| 4 | $44,367–$80,375 | $0 |

Eligibility is straightforward, but income verification is key. For example, a Queens resident we helped in 2024 qualified for $0 premiums with a $30,000 income, saving $2,400 annually. A Buffalo couple with a $50,000 income paid $40/month total, accessing dental and vision care. Our brokers can confirm your eligibility in minutes, ensuring you get the coverage you deserve.

Check your eligibility today to see if the Essential Plan is right for you. Our team at NY Health Insurer is ready to guide you through the process, answering any questions about income limits, immigration status, or plan options.

G

Flowchart: Are You Eligible for the Essential Plan?

How to Enroll in the Essential Plan

Enrolling with NY Health Insurer is simple, keeping you on our platform for a seamless experience:

- Enter Your Zip Code: Use our quoting tool to view Essential Plan options in your area, from NYC to Upstate.

- Provide Household Details: Input income, household size, and healthcare preferences to filter plans.

- Compare Insurers: Review plans from Healthfirst, Fidelis Care, UnitedHealthcare, or MetroPlus Health, each with unique benefits.

- Apply Securely: Complete your application through our encrypted portal, guided by our licensed brokers.

- Renew Annually: Receive reminders to update your plan to maintain continuous coverage.

The Essential Plan’s year-round enrollment offers flexibility, unlike QHPs’ limited windows. In 2024, a Staten Island resident enrolled in a MetroPlus Health plan in 20 minutes, accessing telehealth services immediately. A Rochester client switched to Fidelis Care’s Essential Plan mid-year after a job change, saving $1,200 annually. Our brokers ensure a smooth process, verifying providers like NYC Health + Hospitals or Upstate clinics before you commit.

For more details on the enrollment process, visit our NYSOH enrollment guide, which covers all programs, including the Essential Plan.

Check our Essential Plan income eligibility for 2025 page for the detailed requirements.

Explore Essential Plan Insurers

The Essential Plan is offered by trusted insurers across New York, each with unique benefits tailored to your needs:

Each insurer enhances the Essential Plan with distinct advantages:

- Healthfirst: Offers 24/7 telehealth, ideal for NYC residents needing convenient care, plus access to Brooklyn Hospital Center and Queens Hospital.

- Fidelis Care: Provides free diabetes supplies and community wellness workshops, especially valuable in Upstate areas like Syracuse and Buffalo.

- UnitedHealthcare: Includes up to $100/year for gym memberships, encouraging fitness across urban and rural communities.

- MetroPlus Health: Focuses on NYC, with strong coverage at NYC Health + Hospitals, perfect for Bronx and Manhattan residents.

A Manhattan client we assisted in 2024 chose Healthfirst for its telehealth, saving time on doctor visits. A Buffalo resident opted for Fidelis Care, accessing free glucose monitors for diabetes management. To dive deeper into each provider’s offerings, explore our dedicated guides for Healthfirst, Fidelis Care, UnitedHealthcare, or MetroPlus Health.

NYC vs. Upstate: Essential Plan Differences

The Essential Plan is available statewide, but provider offerings and benefits vary by region, reflecting New York’s diverse healthcare landscape:

- New York City (Manhattan, Brooklyn, Queens, Bronx, Staten Island): MetroPlusHealth and Healthfirst dominate, offering urban-focused perks like 24/7 telehealth and access to NYC Health + Hospitals facilities (e.g., Lincoln Medical Center, Bellevue). A Bronx resident we helped in 2024 enrolled in a MetroPlusHealth plan for $0 premiums, using telehealth for minor ailments. NYC plans emphasize convenience, with dense provider networks for busy residents.

- Upstate New York (Albany, Syracuse, Buffalo, Rochester): Fidelis Care and Excellus BlueCross BlueShield lead, providing community-driven programs like free diabetes supplies, wellness workshops, and rural clinic access. A Syracuse resident we assisted accessed Fidelis Care’s diabetes management resources, saving $1,000 annually. Upstate plans focus on local support, addressing chronic conditions and preventive care.

- Long Island (Nassau, Suffolk Counties): Healthfirst and Fidelis Care offer plans with suburban hospital networks, such as Northwell Health. A Nassau County resident we helped in 2024 enrolled in a Healthfirst plan, saving $1,500 with vision coverage included.

- Hudson Valley and Rural Areas: Fidelis Care provides plans with access to community health centers, ideal for smaller towns. A Hudson Valley client enrolled in 2024, benefiting from free preventive screenings.

These regional differences ensure the Essential Plan meets local healthcare needs, whether you’re navigating NYC’s fast-paced environment or seeking community support in Upstate towns. Our quoting tool tailors plan options to your zip code, and our brokers verify providers to match your preferences, whether it’s a Manhattan specialist or a Buffalo clinic.

For city-specific details, visit our NYC Essential Plan guide, or contact us for Upstate and Long Island options.

Member Stories: Real New Yorkers, Real Impact

The Essential Plan has transformed lives across New York. Here are stories from enrollees we’ve helped:

Maria’s Story: Brooklyn Working Mom

Maria, a 35-year-old single mother, enrolled in Healthfirst’s Essential Plan for $0 premiums. “I get free doctor visits and dental cleanings,” she says, using telehealth to manage her busy schedule. The plan’s coverage at Brooklyn Hospital Center saved her $1,800 in 2024.

John’s Story: Albany Retiree

John, 50, switched to UnitedHealthcare’s Essential Plan, saving $2,000 annually. “The free vision care and gym reimbursement keep me active,” he shares, accessing Albany Medical Center for checkups.

Aisha’s Story: Syracuse Health Advocate

Aisha, 28, chose Fidelis Care’s Essential Plan, receiving free diabetes supplies and attending wellness workshops. “It’s a game-changer for managing my condition,” she says, saving $1,200 in medical costs.

Carlos’s Story: Bronx Entrepreneur

Carlos, 40, enrolled in MetroPlusHealth’s Essential Plan for $0 premiums, covering visits to NYC Health + Hospitals/Lincoln. “Enrollment took 20 minutes,” he notes, saving $2,400 in 2024.

Linda’s Story: Long Island Teacher

Linda, 45, joined Healthfirst’s Essential Plan, paying $20/month and accessing Northwell Health for vision care. “The savings and coverage are incredible,” she says, cutting costs by $1,500.

These stories reflect the Essential Plan’s impact, from urban NYC to rural Upstate. Whether you’re seeking telehealth in Manhattan or diabetes support in Syracuse, the plan delivers. Call (888) 215-4045 to become the next success story.

Frequently Asked Questions

What is the New York Essential Plan?

A state-sponsored health insurance program offering free or low-cost coverage for eligible New Yorkers, including medical, dental, vision, and telehealth services.

Who qualifies for the Essential Plan?

Residents aged 19–64, living in New York, with incomes 138%–250% FPL (e.g., $21,597–$39,125 for a single adult in 2025), U.S. citizens or eligible immigrants, not on Medicaid or Medicare.

What benefits does the Essential Plan cover?

Medical care, prescriptions, dental, vision, mental health, telehealth, gym reimbursements, community programs, and maternity care.

Are there costs with the Essential Plan?

$0 premiums for incomes 150% FPL up to 250% FPL, with low or no copays for most services.

Can DACA recipients enroll?

Yes, eligible immigrants, including DACA recipients, can enroll, making the plan inclusive for diverse communities.

How does the Essential Plan differ from Medicaid?

The Essential Plan targets incomes 138%–250% FPL, includes dental and vision, and has $0/month premiums, while Medicaid is for lower incomes with limited dental/vision coverage.

Which insurers offer the Essential Plan?

Healthfirst, Fidelis Care, UnitedHealthcare, and MetroPlus, each with unique perks like telehealth or wellness programs.

Can I enroll anytime?

Yes, the Essential Plan offers year-round enrollment, unlike QHPs’ limited windows.

Get Covered with the Essential Plan

Secure affordable, comprehensive health insurance with NY Health Insurer’s expert support. Call (888) 215-4045 to begin.

Get a quote now to explore your Essential Plan options.