NY Student Health Insurance: Options for Students in New York

Compare school-sponsored, marketplace, and public health plans available to college students in NY.

Who Needs Student Health Insurance in NY?

If you’re enrolled in a college or university in New York, you may be required to have health insurance coverage. Many schools automatically enroll full-time students into a student health plan unless they provide proof of existing coverage. If you’re under age 26, you may still be eligible under a parent’s plan — but depending on your situation, that might not be the most affordable or flexible option.

International students, graduate students, and part-time students may also face different requirements. Understanding your school’s specific policy is essential to avoid gaps in coverage or unexpected costs.

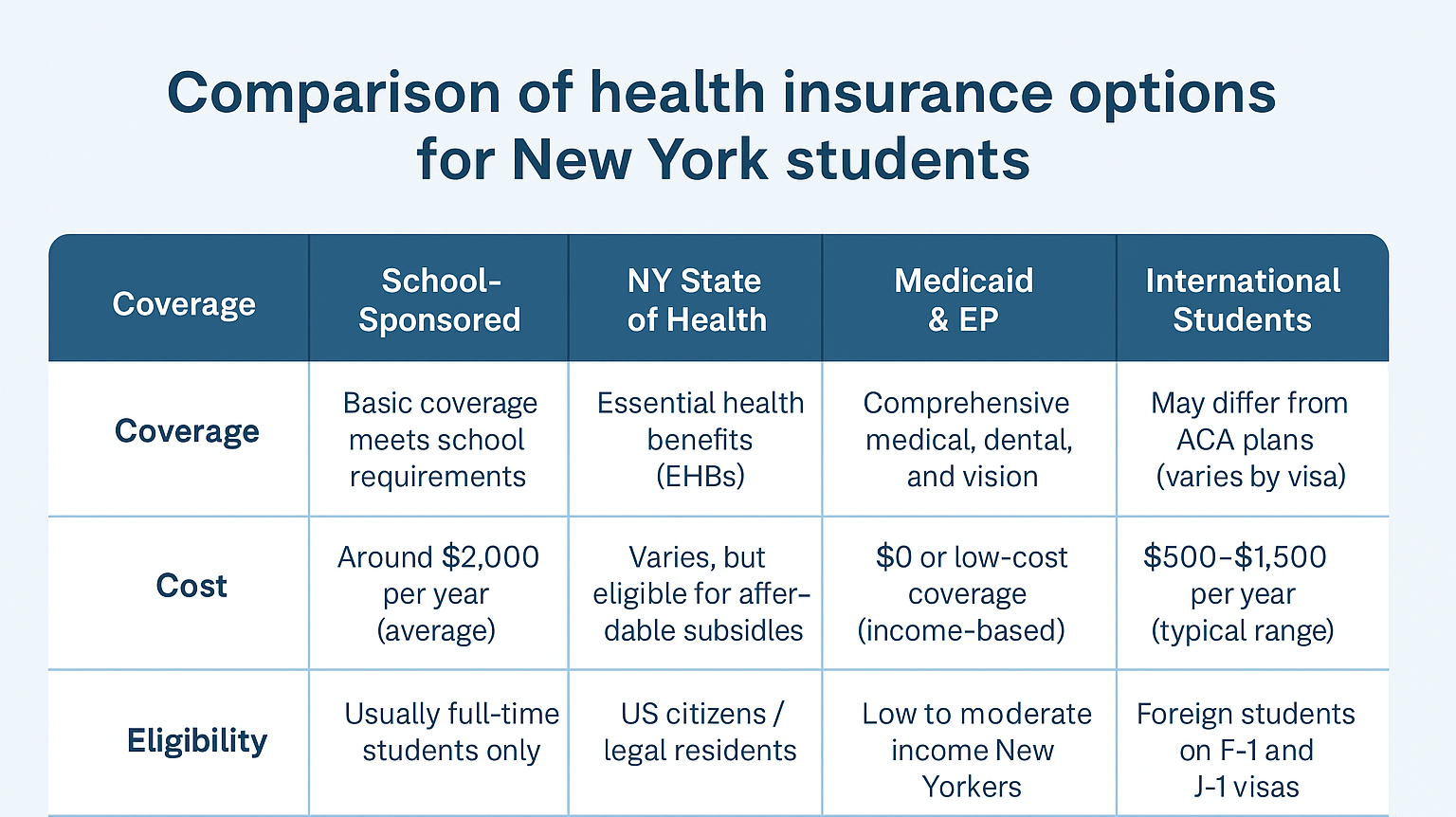

Your Health Insurance Options as an NY Student

- School-Sponsored Plans: Offered by SUNY, CUNY, and private colleges. These are comprehensive but may be more expensive than marketplace or public plans. They typically include on-campus care and may waive out-of-network services.

- Marketplace Plans (NY State of Health): ACA-compliant options that offer subsidies based on income. Many students with lower incomes qualify for generous premium reductions and cost-sharing subsidies.

- Parent’s Insurance: If you are under 26, you can usually stay on your parent’s health plan. However, check if the plan’s network includes providers near your campus.

- Medicaid & Essential Plan: Available to qualifying low-income individuals. Medicaid offers comprehensive coverage at no cost, while the Essential Plan is ideal for those who don’t qualify for Medicaid but still need a low-cost option.

- International Student Plans: Required for F-1 and J-1 visa holders. These plans must meet specific coverage requirements, and some schools offer dedicated options that simplify enrollment.

Overview of student health insurance options in NY

How to Apply for Student Health Insurance

- School plans are typically handled through the bursar or student affairs office and may be included in tuition unless waived.

- Marketplace plans are available through the NY State of Health website during open enrollment or a qualifying special enrollment period.

- Medicaid and the Essential Plan require proof of income and residency, and applications can be started online or with assistance from licensed brokers like us.

Overview of student health insurance options in NY

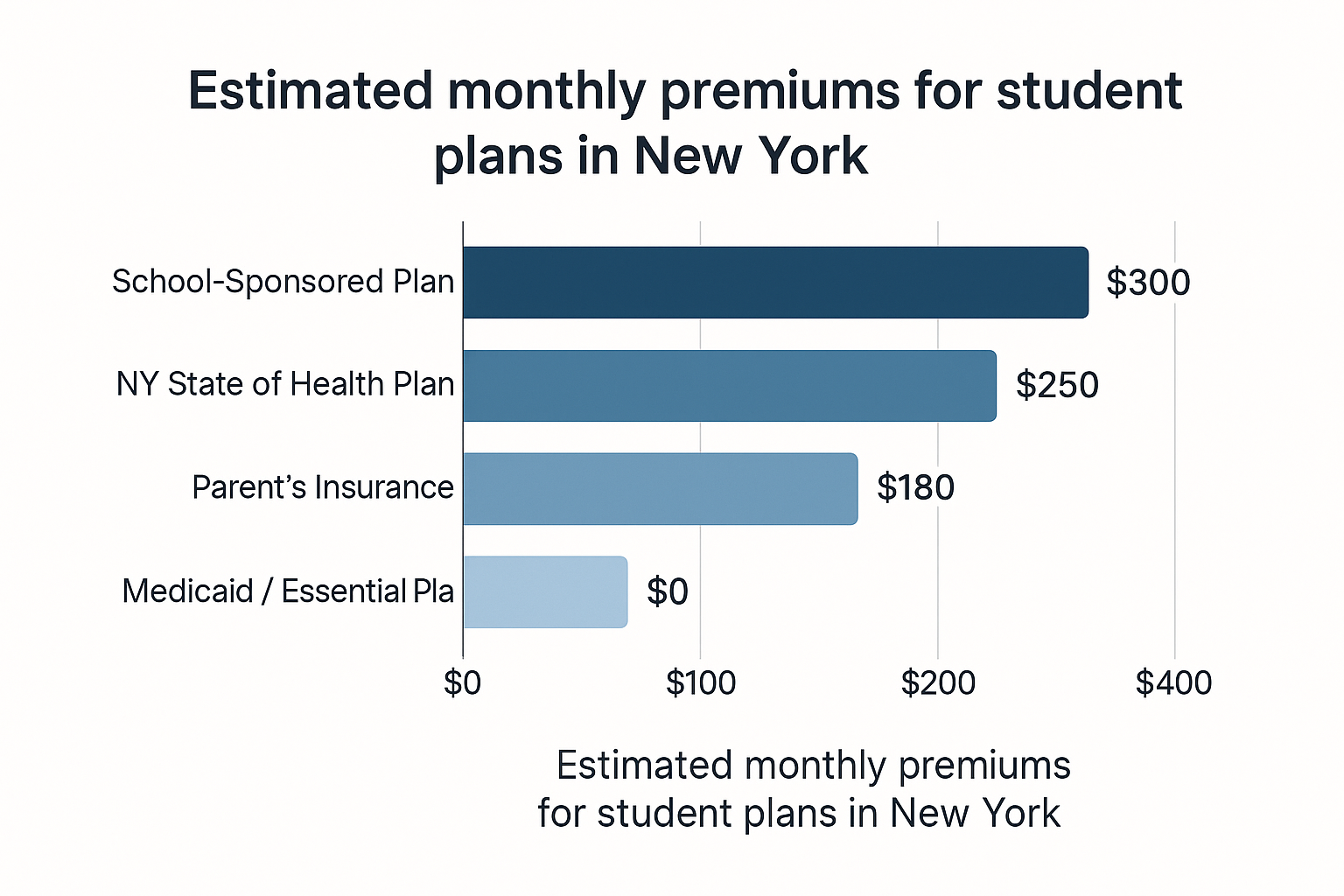

- Marketplace Plans: With subsidies, many students pay $50/month or less. The Essential Plan often has $0 monthly premiums and low copays.

- School-Sponsored Plans: Annual premiums range from $1,800–$2,500, sometimes higher at private institutions.

- Medicaid: Offers full coverage for eligible students at no cost, including dental and vision benefits.

Our team can help you estimate monthly costs and find the most cost-effective plan based on your income and student status.

Dental and Vision Coverage

School-sponsored plans often include dental and vision care, though the extent of coverage may be limited. Medicaid provides robust dental benefits, including preventive services, while the Essential Plan includes both dental and vision coverage for eligible individuals. If your plan doesn’t include these services, you can purchase standalone dental or vision insurance at a low monthly cost.

International Student Health Insurance in NY

Most F-1 and J-1 visa holders are required to carry valid health insurance for the duration of their studies. Many colleges offer pre-approved plans for international students. However, if you’re allowed to choose your own policy, we can help ensure it meets all federal and institutional requirements — including emergency services, mental health, repatriation, and evacuation coverage.

Our plans are accepted at most NY colleges and universities and can be activated immediately to avoid enrollment delays.

Best Plans by Student Type

- Community College Students: Often qualify for free or low-cost coverage through Medicaid or the Essential Plan.

- Graduate Students: Typically need more comprehensive plans; may choose between school-sponsored or marketplace options depending on stipends or assistantship income.

- International Students: Must meet visa requirements; we offer pre-approved plans for NY schools.

- Part-Time or Online Students: May not be eligible for school plans but often qualify for subsidized ACA coverage or Medicaid depending on income.

Tips for Saving on Student Health Insurance

- Compare multiple plan types: Don’t default to your school’s plan without exploring marketplace and Medicaid options.

- Look into subsidies: Use NY State of Health to see if you qualify for reduced premiums through the Essential Plan.

- Watch out for overlapping coverage: If you’re on a parent’s plan, you might be able to waive the school’s plan and save money.

- Use in-network providers: Always use providers within your plan’s network to minimize out-of-pocket costs.

- Ask about student discounts: Some private health insurers offer student-specific rates not listed publicly.

Summary: Choosing the Right Health Insurance as a Student

Whether you’re attending a SUNY school, a private college, or coming to New York from abroad, you have several health insurance options. Understanding your eligibility and comparing plans can save you hundreds of dollars each year. Vista Health Solutions is here to help you make the smartest decision for your health and budget.

Start with a free quote and see what you’re eligible for today.

Frequently Asked Questions

Can I stay on my parent’s insurance while attending college?

Yes, until age 26. However, it’s important to ensure that your parent’s plan has in-network providers near your college campus, especially for routine and emergency care.

Are student health insurance plans mandatory in NY?

Many schools in New York require students to maintain health coverage. Some automatically enroll students in their sponsored plan unless a waiver is submitted by a deadline.

What happens when I graduate or lose coverage?

If you lose student coverage due to graduation, aging out, or dropping below full-time status, you qualify for a special enrollment period on the NY State of Health marketplace. You may also qualify for Medicaid based on income.

Are there insurance options for part-time students?

Yes. While some school-sponsored plans exclude part-time students, the NY State of Health marketplace and Medicaid both provide coverage options regardless of school status.

What’s the best health plan for international students in NY?

It depends on your visa status and school policy. Some schools mandate specific plans, while others allow external coverage that meets basic criteria. We can help you find affordable, compliant plans accepted at NY institutions.

Overview of student health insurance options in NY

“I had no idea I qualified for the Essential Plan with a $0 premium. Vista Health helped me sign up in less than 30 minutes!”

— Luis R., Bronx Community College

“As an international grad student, finding insurance that met my visa requirements was overwhelming. Their team made it easy.”

— Anna S., NYU

“My school’s plan was too expensive, and I didn’t know there were better options. Vista helped me find a marketplace plan that costs $42/month and covers everything I need.”

— Stephanie M., SUNY Albany

Why Choose Vista Health Solutions?

- 20+ years serving NY residents

- Specialized guidance for college, graduate, and international students

- Licensed brokers who work with all major plans on the NY marketplace

- Free quotes, fast enrollment, and expert support every step of the way