Health Plans in NY: Compare Prices & Save More

Health insurance in New York doesn’t have to be expensive. Whether you’re a student in Buffalo, a freelancer in Queens, or a parent in Westchester, there are affordable plan options to fit your needs and your budget. Let’s explore how New Yorkers are saving money—and how you can too.

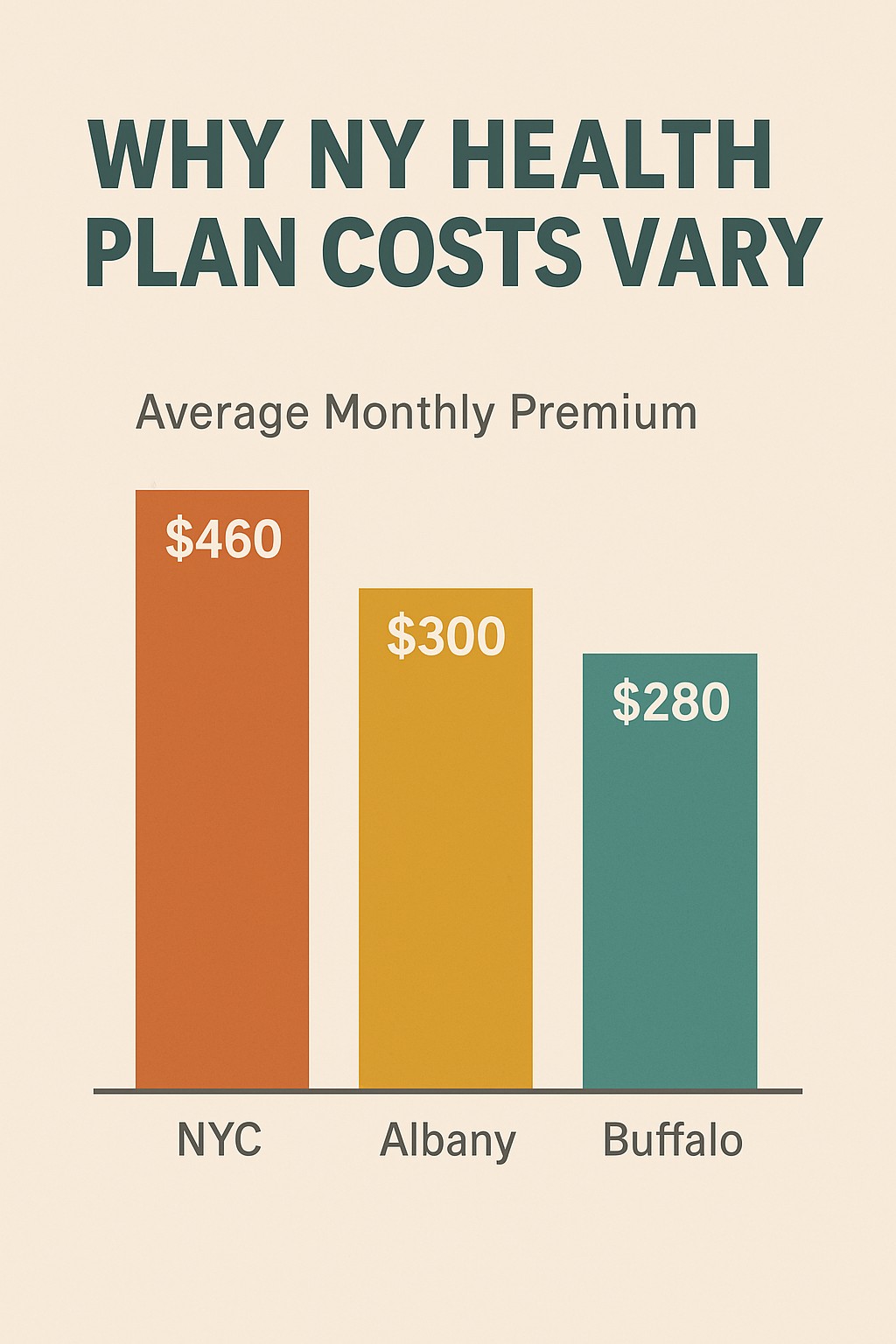

Why Health Plan Costs Vary Across NY

Premiums and plan availability can change dramatically based on where you live, how much you earn, and what type of plan you choose. For instance, individuals under 30 may qualify for catastrophic coverage, while those earning less than 200% of the Federal Poverty Level can often access $0 Essential Plans. Urban regions like NYC tend to have more insurer competition, whereas upstate areas often rely more on PPO networks due to limited provider access. Urban areas may have more competition among insurers, while rural counties may rely more heavily on PPOs due to provider access. Subsidies also affect prices significantly if you qualify.

For example, a Bronze plan might cost $300 in Albany but $460 in Manhattan. Knowing your options starts with understanding the landscape.

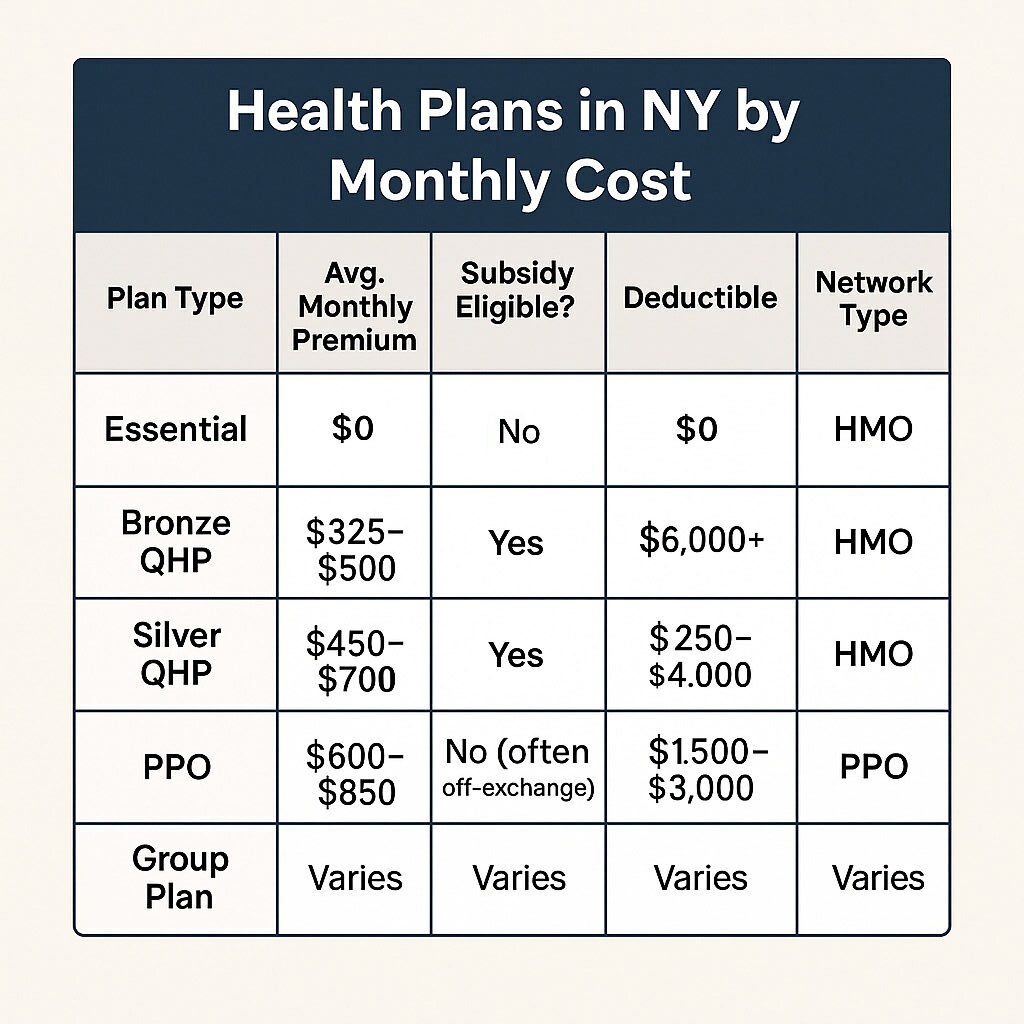

Plan Type Cost Comparison

This comparison shows average monthly premiums, deductible amounts, and subsidy eligibility. Each plan type serves different needs: Essential Plans are ideal for low-income individuals and those without employer coverage. Bronze and Silver QHPs work well for moderate earners who want balanced coverage with cost-sharing reductions. PPOs provide flexibility for those needing access outside New York or to out-of-network specialists. Group plans are generally offered by small businesses and vary based on the employer’s contribution. Use it as a starting point to decide which plan type matches your financial and medical needs.

| Plan Type | Avg. Monthly Premium | Subsidy Eligible? | Deductible | Network Type |

|---|---|---|---|---|

| Essential Plan | $0–$20 | No | $0 | HMO |

| Bronze QHP | $325–$500 | Yes | $6,000+ | HMO |

| Silver QHP | $450–$700 | Yes | $2,500–$4,000 | HMO |

| PPO | $600–$850 | No (often off-exchange) | $1,500–$3,000 | PPO |

| Group Plan | Varies | Varies | Varies | HMO / PPO |

Plan Breakdown:

Essential Plan: Ideal for low-income New Yorkers. It’s the only plan with $0 premiums and no deductibles for most.

Bronze QHP: Great for younger adults with low expected usage who want the lowest premiums but higher out-of-pocket costs.

Silver QHP: Best for moderate-income earners—especially those eligible for cost-sharing reductions.

PPO: Offers national access and flexibility. Best for frequent travelers or those with out-of-network provider needs.

Group Plan: Often employer-sponsored. Costs and coverage vary but may include richer benefits if subsidized by the employer.

Cost Tips Based on Your Income Level

How much you pay for health insurance in New York depends heavily on your Modified Adjusted Gross Income (MAGI). These tips can help you maximize your savings based on your bracket:

- Under 138% FPL: You likely qualify for Medicaid — a public health insurance program offering comprehensive coverage at no cost, with broader eligibility and year-round enrollment.

- 138%–250% FPL: You likely qualify for a $0 Premium Essential Plan with no deductible or co-pay for many services.

- 250%–400% FPL: Consider a Silver QHP with cost-sharing reductions, which lower your deductible and copays.

- Over 400% FPL: Look into PPOs or employer-sponsored group plans. Even without subsidies, a higher deductible HSA plan could save you in taxes.

How Real New Yorkers Saved on Health Plans

Elena – Staten Island: “I used to pay over $750/month for a basic plan. NY Health Insurer found me a Silver plan that included my OBGYN and saved me nearly $2,000 per year.”

Thomas – Rochester: “I didn’t qualify for subsidies but still saved $1,500 annually by switching from a PPO to a Bronze QHP.”

Jessica – Brooklyn: “I was paying over $1,000/month for a PPO. After using NY Health Insurer, I switched to a Silver plan and saved over $500 per month.”

Marcus – Albany: “As a freelancer, I qualified for a Bronze QHP with subsidies. I cut my premiums in half and used an HSA to reduce my taxable income.”

Samir – Queens: “With two kids and rising costs, I found an Essential Plan that gave me full coverage and zero monthly premiums. Game changer.”

When Cheap Isn’t Better: Avoiding Underinsurance

While low premiums are attractive, many New Yorkers regret choosing the cheapest plans when emergency care arises. Consider these factors:

- Does the plan cover your preferred doctors and hospitals?

- Are urgent care and ER visits subject to high deductibles?

- What’s the out-of-pocket maximum for a bad year?

NY Health Insurer helps you look beyond premiums to avoid costly surprises later. We focus on your total cost—not just what you pay monthly.

Frequently Asked Questions

Choosing a health plan in New York can be overwhelming—especially with the number of options and price tiers. Here are answers to the most common questions we hear from clients:

What’s the cheapest health plan in NY?

For most people earning under 250% of the Federal Poverty Level, the Essential Plan is the lowest-cost option, with $0 premiums and no deductibles.

Are PPOs worth the extra cost?

PPOs offer flexibility and nationwide coverage but often cost significantly more. They’re ideal for those needing specialist access or traveling frequently.

Can I switch plans mid-year?

Yes, if you experience a qualifying event like job loss, income change, or relocation, you may be eligible for a Special Enrollment Period.

Do I need to renew my plan every year?

Yes, plans must be renewed during Open Enrollment, or during a Special Enrollment Period if you qualify. Auto-renewals may not include updated subsidy calculations, so reviewing your options annually is key.

Are dental and vision included?

Most medical plans do not include adult dental or vision coverage by default. However, many insurers offer low-cost add-ons during enrollment.

Get a Personalized Cost Comparison

Every New Yorker deserves a health plan that’s affordable and reliable. NY Health Insurer compares multiple carriers in your area to uncover hidden savings opportunities and subsidy-eligible plans you may not even know exist.

Wondering how much you could save? Our free quote tool helps New Yorkers find plans that match both their budget and health needs. You’ll see real numbers—based on your income, household size, and ZIP code—in under 60 seconds.