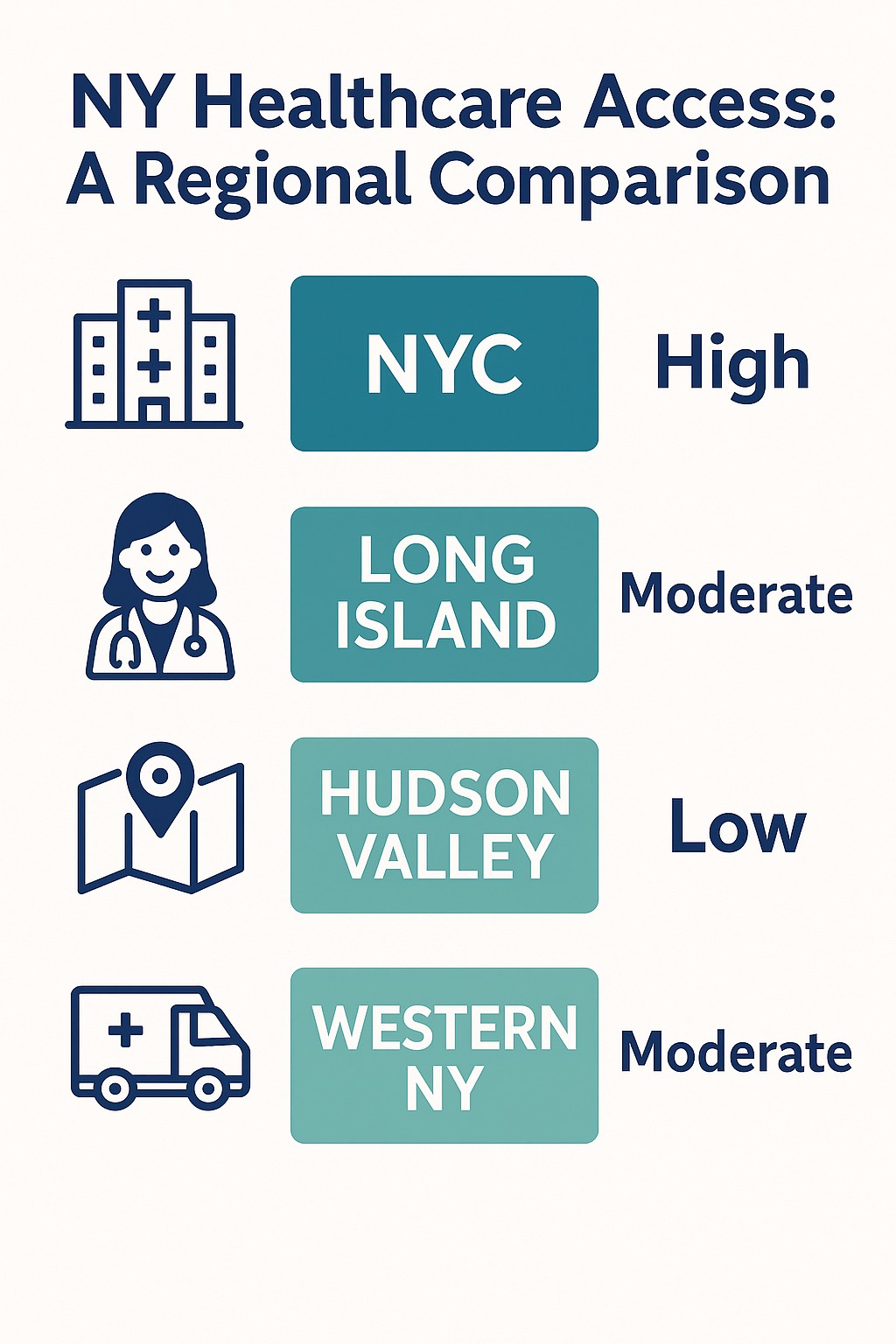

NY Healthcare: Comparing Access Across Regions

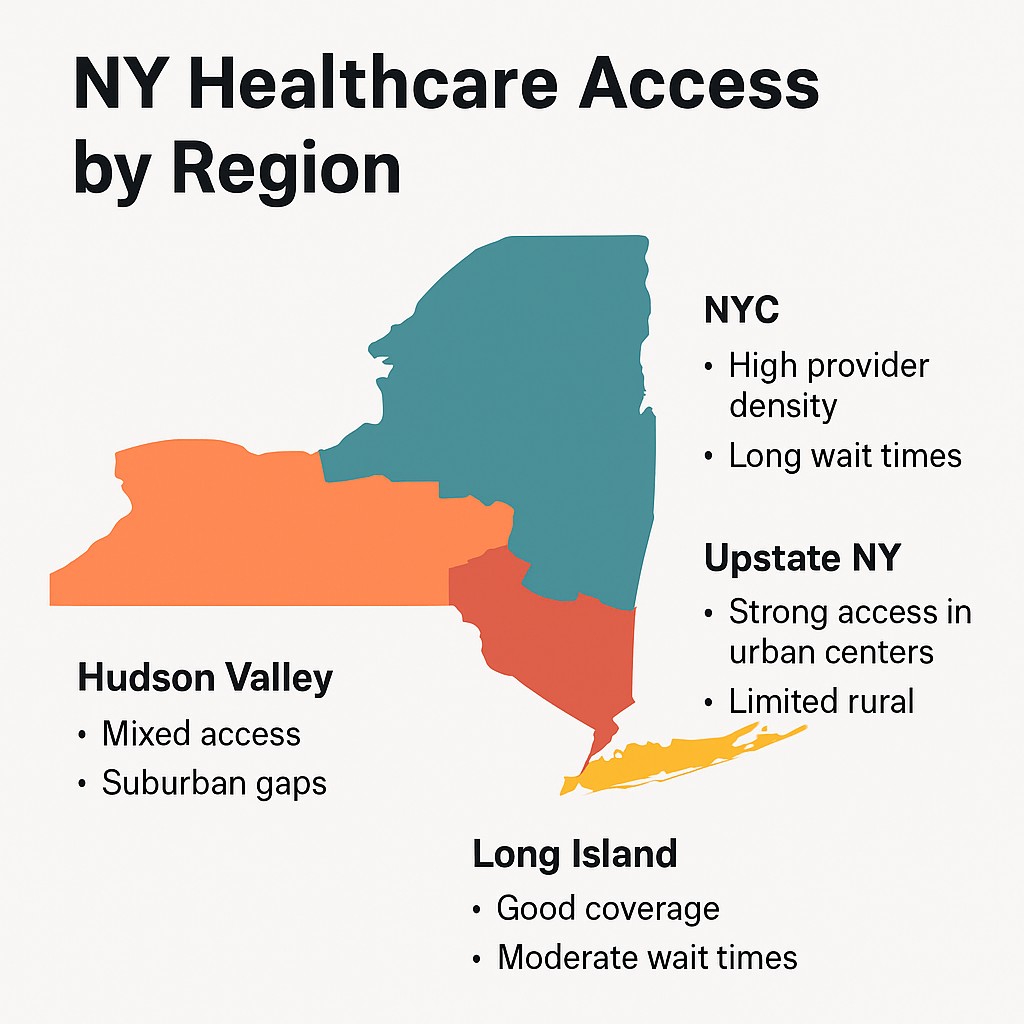

New Yorkers across the state have vastly different experiences when it comes to accessing healthcare. Whether you live in Brooklyn, the Finger Lakes, or Long Island, the type of plans available—and the quality of provider networks—can vary significantly. At NY Health Insurer, we help you explore the best options based on where you live.

Urban Healthcare: NYC & Boroughs

Access in urban areas also means faster onboarding with digital ID cards and integration with pharmacy systems like CVS or Walgreens. In NYC, many plans support same-day urgent care visits, virtual check-ins, and on-demand prescription refills. For residents managing chronic conditions, these tech-forward solutions can greatly reduce wait times and transportation needs.

New York City offers the widest variety of plans, thanks to a dense network of providers and hospitals. Residents in the five boroughs have strong access to Qualified Health Plans (QHPs) and the Essential Plan. In 2025, more than 60% of enrollees in NYC used online tools or apps to manage their care, and telehealth saw a 35% adoption rate in Brooklyn alone.

Plans from insurers like MetroPlus and Healthfirst are commonly selected by urban residents for their affordability and broad provider networks. For lower-income families, the Essential Plan remains one of the most utilized options in the city, with zero premiums and $0 deductibles.

Suburban Access: Long Island & Westchester

Suburban residents also benefit from expanded behavioral health coverage in 2025, with new mandates requiring plans to cover in-network therapy visits. This has led to a surge in mental health utilization, particularly among families with teens. Access to suburban urgent care clinics has also improved due to high demand and insurer partnerships with local health systems.

In cities and towns across Nassau, Suffolk, and Westchester Counties, New Yorkers can access both marketplace and private insurance plans. Competition among insurers like EmblemHealth, Fidelis Care, and UnitedHealthcare has driven premium stabilization in recent years. Suburban residents often choose plans that balance cost and specialist access, particularly for families and retirees.

Unlike NYC, some suburban regions offer better appointment wait times and more provider availability per enrollee. Many residents also qualify for premium assistance based on income, helping them afford Silver or Gold-tier plans with strong coverage for prescription drugs and diagnostics.

Upstate & Rural New York

Rural residents may also qualify for travel stipends or remote monitoring services, depending on the insurer. These services can reduce the need for in-person visits and help manage conditions like diabetes, hypertension, or asthma. NY Health Insurer brokers guide rural enrollees through eligibility for these enhanced benefits.

Access to healthcare in rural and upstate regions of New York remains a challenge. Cities like Syracuse serve as medical hubs for surrounding rural areas, but still face challenges with provider availability. While most counties are covered by insurers like Excellus BlueCross BlueShield and MVP Health Care, the number of in-network providers may be lower. As a result, PPO plans—known for their flexibility and out-of-network coverage—are more popular upstate than in other parts of NY.

To address provider shortages, New York invested $50 million in 2024–2025 into rural health clinics and telehealth infrastructure. This has improved access in areas like the North Country, the Southern Tier, and the Adirondacks. NY Health Insurer helps rural residents compare plans that include transportation benefits, mental health services, and multi-state coverage.

How Location Affects Healthcare Coverage

Healthcare access isn’t just about the plan—it’s also about geography. Premiums can differ by hundreds of dollars based on ZIP code, and rural residents may need to travel further for care. Choosing the right plan involves understanding local provider networks and how often you’ll use services like labs, specialists, or urgent care.

In Queens, for example, a Silver-tier QHP may offer 90% provider coverage within a 5-mile radius, while in St. Lawrence County, that drops to 40%. PPOs are often recommended in rural areas to accommodate travel across state lines or counties for care. NY Health Insurer helps you weigh the costs and coverage by region.

User Stories Across NY

Each region of New York presents different challenges and solutions—from rural areas to cities like Rochester. Here’s how real people from across the state are navigating healthcare access with support from NY Health Insurer:

Lisa – Manhattan Resident: “I used telehealth for therapy and doctor visits all year. My Essential Plan covers everything with zero copays.”

John – Suffolk County Parent: “We needed a plan that covered our kids’ specialists. The Silver-tier plan we found through NY Health Insurer fit perfectly.”

Elena – Westchester Teacher: “I needed a plan that supported mental health care and frequent physicals. NY Health Insurer helped me compare two Silver-tier options with strong suburban networks.”

Marcy – Rural Freelancer in Otsego: “There aren’t many local providers, so I use a PPO with out-of-network options. It gives me peace of mind when I travel for work.”

Frequently Asked Questions

Healthcare rules in New York can be confusing, especially when they vary by region. These FAQs cover common concerns for residents navigating regional access differences.

Do healthcare plans vary by ZIP code?

Yes. Plan availability, provider networks, and premiums can change by ZIP code or county in New York.

Is there support for rural healthcare access?

Yes. New York State has invested in rural clinics and telehealth expansion. Some plans offer transportation or out-of-network benefits for rural enrollees.

Can I switch plans if I move to another region?

Yes. A move to a new ZIP code qualifies you for a Special Enrollment Period. You can change plans based on your new location’s offerings.

Find Plans Based on Where You Live

At NY Health Insurer, our team uses ZIP-code level insights to help you select plans accepted by local hospitals, urgent care centers, and specialists in your area. Whether you live in a metro zone or a rural township, we tailor your quote results to reflect the real choices available to you.

Your healthcare experience in New York is shaped by where you live. Use our quoting tool to explore plans specific to your county or ZIP. Our brokers understand regional differences and help you get the coverage you need—whether in the heart of NYC or upstate farmland.