Medical Insurance NY for Every Stage of Life

New York residents face a wide variety of medical insurance needs depending on their lifestyle and responsibilities. Whether you’re raising a family, self-employed, or running a small business—whether you’re based in Buffalo or New York City—the right medical insurance can help you reduce costs while gaining access to quality care. NY Health Insurer makes this process easier by offering customized guidance and tools tailored to your life stage.

Instead of a one-size-fits-all solution, our brokers focus on three main groups of New Yorkers who are often underserved in the current insurance landscape. On this page, you’ll find plan comparisons, cost breakdowns, and real-world stories of how people in similar situations found affordable coverage that actually works for them.

Medical Insurance for Families in New York

Choosing a plan also means thinking about emergencies. Families often face unexpected costs like ER visits, urgent care, or diagnostic tests. Choosing a plan with low emergency room copays and predictable out-of-pocket maximums can protect your budget during sudden health events. Plans from insurers like Fidelis Care and Healthfirst often include generous pediatric coverage and allow families to bundle dental and vision plans for convenience.

Raising a family in New York means you need health coverage that’s reliable, pediatric-focused, and affordable. Families with children benefit most from plans that include preventive care, immunizations, dental options, and access to pediatricians in-network. For many households earning under 250% of the Federal Poverty Level, the Essential Plan offers $0 premiums with no deductible and low copays—an ideal fit for families balancing childcare, school, and work.

Families earning slightly more often enroll in Silver-tier Qualified Health Plans (QHPs) through NY State of Health. These plans offer cost-sharing reductions and typically balance premium affordability with manageable out-of-pocket costs. In 2025, over 45% of enrolled families in NYC chose Silver plans because of these advantages. Pediatric vision and dental coverage are available as add-ons or bundled options.

Many New York counties, especially in the Hudson Valley and Long Island, have added new pediatric providers in 2024–2025 due to increased state funding. This expanded provider access helps reduce wait times and improve continuity of care for children and teens across the state. NYHealthInsurer also serves families in cities like Syracuse with tools to compare pediatric-friendly health plans.

Self-Employed & Freelancers: Coverage with Flexibility

Some freelancers, especially in the gig economy, move frequently or travel for work. PPOs provide portability that HMOs typically lack. Additionally, many off-exchange plans offer supplemental coverage like accident protection or critical illness benefits, which freelancers value due to income unpredictability. NY Health Insurer often assists creatives, contractors, and part-time consultants in selecting hybrid plans that balance network access and affordability.

If you’re a freelancer, consultant, or creative professional in New York, finding a flexible health plan is essential. Unlike employees who may receive employer-sponsored benefits, the self-employed must evaluate individual market plans or specialized private offerings. PPO plans are often preferred because they offer nationwide coverage, broad provider networks, and fewer restrictions on specialist visits.

For 2025, self-employed New Yorkers increasingly use off-marketplace PPO plans or Bronze-tier QHPs. Bronze plans offer low monthly premiums with higher deductibles—ideal for healthy individuals who primarily want protection against emergencies. Freelancers can also deduct premiums and out-of-pocket expenses as business expenses on their taxes, reducing overall costs.

NY Health Insurer supports many of these clients through our PPO quoting tool and live broker consultations. We’ve seen a 35% increase in PPO adoption among self-employed individuals in Manhattan, Brooklyn, and Buffalo in the last year. Access to telehealth, mental health services, and out-of-network coverage has driven this trend.

Group Health Plans for Small Business Owners

Employers also appreciate that offering medical insurance enhances employee morale and reduces turnover. A recent survey found that 72% of NY employees said health benefits influenced their decision to stay with a company. Businesses in industries like hospitality, construction, and child care particularly benefit from flexible plans that accommodate seasonal hiring patterns.

Small business owners in New York have unique needs when it comes to medical insurance. Offering group coverage not only attracts and retains employees but also makes your team more productive and secure. Group health plans, including those offered through the NY State of Health SHOP (Small Business Marketplace), are designed for businesses with 1 to 100 employees.

If you’re a business owner in Albany, NYHealthInsurer can help you compare group plan options tailored to your team’s size and budget.

In 2025, businesses with fewer than 25 employees may qualify for tax credits covering up to 50% of premium costs if they purchase through the official SHOP exchange. Some off-exchange group plans may also offer flexibility for adding part-time or seasonal workers. Many NY employers also include dental, vision, and HSA contributions to boost plan appeal.

Enrollment in small group plans increased by 18% in 2024–2025, with high participation in Queens, Albany, and Rochester. At NY Health Insurer, we help small business owners navigate employee eligibility, payroll integration, and carrier selection across the state’s top insurers.

Compare NY Medical Plans by Life Stage

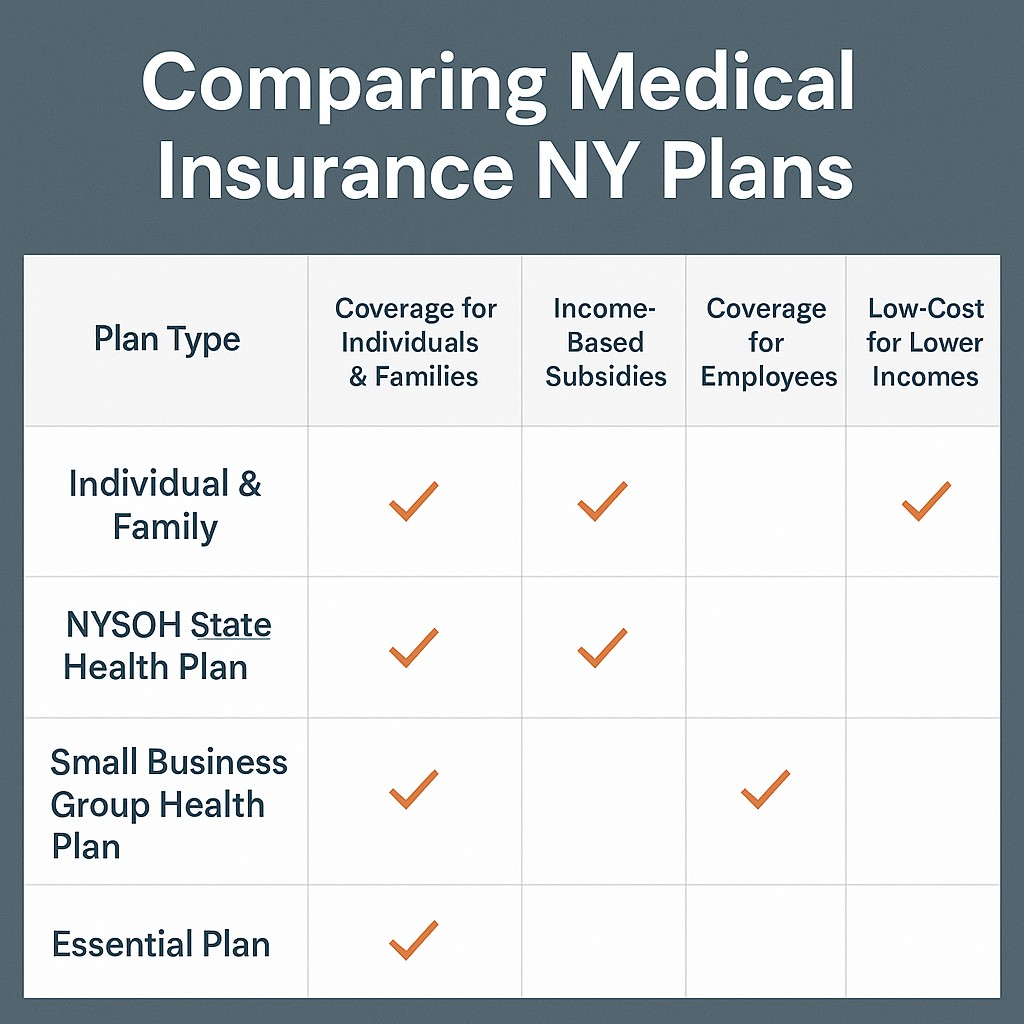

This chart helps summarize which plans are typically the best fit depending on your situation. NY Health Insurer brokers can help you refine these options further by estimating real costs with subsidies or group discounts applied.

| Life Stage | Best Plan Type | Avg. Monthly Premium | Key Benefits |

|---|---|---|---|

| Families | Essential Plan, Silver QHP | $0–$250 | Free preventive care, low copays, pediatric coverage |

| Freelancers | PPO, Bronze QHP | $300–$750 | Nationwide coverage, tax-deductible, telehealth |

| Small Businesses | Group Plans (SHOP or private) | Varies by group size | Tax credits, employee retention, bundled dental/vision |

Real Stories from Across New York

Sofia – Bronx Nurse: “Switching to a Silver-tier plan allowed me to keep my OB-GYN and pediatrician, both of whom were in-network. I pay just $35 a month after tax credits.”

Leo – Staten Island Contractor: “I needed a PPO because I work jobs across New Jersey and Pennsylvania. NY Health Insurer helped me find a plan that includes urgent care nationwide.”

Monica – Brooklyn Parent: “We enrolled in an Essential Plan with $0 monthly premium for our two kids and saved $2,400 this year. It covered vaccinations and checkups without any hassle.”

Raj – Queens Freelancer: “As a self-employed web developer, I chose a PPO that lets me see my specialist in New Jersey. It’s tax-deductible and fits my unpredictable schedule.”

Carlos – Albany Café Owner: “I used NY Health Insurer’s support to find a group plan that covers all 6 of my employees. We qualified for a tax credit and even added vision benefits.”

FAQs: Medical Insurance in New York

What counts as medical insurance NY?

Medical insurance in NY includes QHPs, the Essential Plan, PPOs, and employer-sponsored group plans regulated by the state or private carriers.

Can freelancers get affordable coverage?

Yes, freelancers may qualify for subsidies through NYSOH or choose private PPOs with tax advantages and broader networks.

How do small businesses enroll in group plans?

Small businesses can enroll via NY State of Health’s SHOP or through a licensed broker. Tax credits may apply depending on size and wages.

Start Your Personalized Quote

No matter your background or income level, New York offers a range of medical insurance options. The key is to identify your life stage, understand the types of plans that match it, and explore options with professional help. NY Health Insurer is here to make that process simple and supportive every step of the way.

Don’t settle for generic insurance advice. Whether you’re managing a household, growing a business, or freelancing full-time, NY Health Insurer provides tailored options to match your lifestyle and income. Click below to compare quotes by life stage and get expert help.