Healthy NY Income Limits Explained

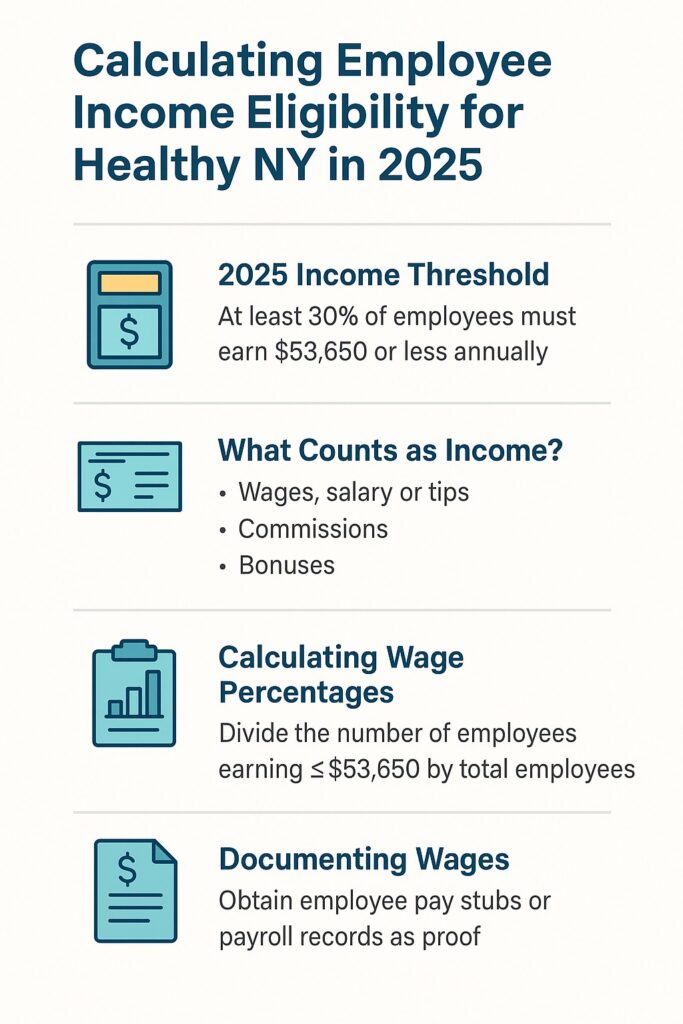

To qualify for Healthy NY in 2025, small businesses must ensure that at least 30% of their employees earn $53,650 or less annually. This income threshold is a critical part of eligibility. This guide explains how the threshold works, what counts toward income, and how to document employee wages accurately.

What Is the Income Limit for Healthy NY?

For 2025, employees earning $53,650 or less annually may be counted toward the 30% eligibility requirement. This figure is adjusted annually based on federal guidelines and cost of living estimates in New York.

What Counts Toward Employee Income?

- Base salary or hourly wages

- Excludes bonuses, overtime, commissions, or employer contributions to benefits

- Wages must be projected on an annualized basis

How to Calculate the 30% Rule

Start by creating a complete employee census that includes job titles and annual wages. Then:

- Count the total number of full-time employees (working 20+ hours/week)

- Count how many of those employees earn $53,650 or less

- If at least 30% fall below the income threshold, your business meets this requirement

Examples: Who Qualifies?

✅ Example A – Qualifies: A Queens-based salon employs 10 people. Four stylists and one receptionist earn under $50,000. The other five earn more. With 5/10 employees under the threshold (50%), the business qualifies.

❌ Example B – Doesn’t Qualify: A small consulting firm has 8 staff, all making $60,000+. None qualify under the wage threshold, so the business is ineligible.

How to Document Wages

Prepare to show:

- Recent payroll reports (last 3 months)

- W-2s or wage statements

- Employee census with names, roles, and compensation

Ensure data is recent and reflects current staffing. Round salaries up to annual equivalents if employees are paid hourly or seasonally.

Still unsure if your team meets the wage threshold? Call (888) 215-4045 to speak with a licensed NY Health Insurer advisor or start your quote online.

Or return to our Healthy NY overview page to learn more.