Essential Plan 200-250 vs Essential Plan 1: Which Is Right for You?

Compare Essential Plan 200-250 and Essential Plan 1 to find the best free health insurance in NY. Contact nyhealthinsurer.com—call (888) 215-4045.

For a broader overview, check out our comprehensive New York Essential Plan guide.

Overview: Essential Plan 200-250 vs Essential Plan 1

The New York Essential Plan offers free health insurance for residents who don’t qualify for Medicaid but need affordable coverage. Within this program, Essential Plan 1 and Essential Plan 200-250 are two popular options, differing mainly in income eligibility and out-of-pocket costs. Essential Plan 1 targets incomes 150%–200% of the Federal Poverty Level (FPL), while Essential Plan 200-250, introduced in 2023, covers 200%–250% FPL. This guide compares their costs, eligibility, and benefits to help you choose the right plan.

Both plans offer $0 premiums and comprehensive coverage, but their cost-sharing structures vary. Whether you’re a single professional in NYC or a family in Albany, understanding these differences is key to selecting the best option.

Eligibility: Who Qualifies for Each Plan?

Eligibility for both plans shares common requirements but differs in income thresholds:

| Criteria | Essential Plan 1 | Essential Plan 200-250 |

|---|---|---|

| Income (2024 FPL) | 150%–200% FPL ($22,590–$30,120 for a single person) | 200%–250% FPL ($30,120–$37,650 for a single person) |

| Age | 19–64 | 19–64 |

| Citizenship | U.S. citizen or eligible immigrant | U.S. citizen or eligible immigrant |

| Other Insurance | Not enrolled in Medicaid/Medicare | Not enrolled in Medicaid/Medicare |

For detailed income eligibility, see our income eligibility guide.

Cost Comparison: Essential Plan 200-250 vs Essential Plan 1

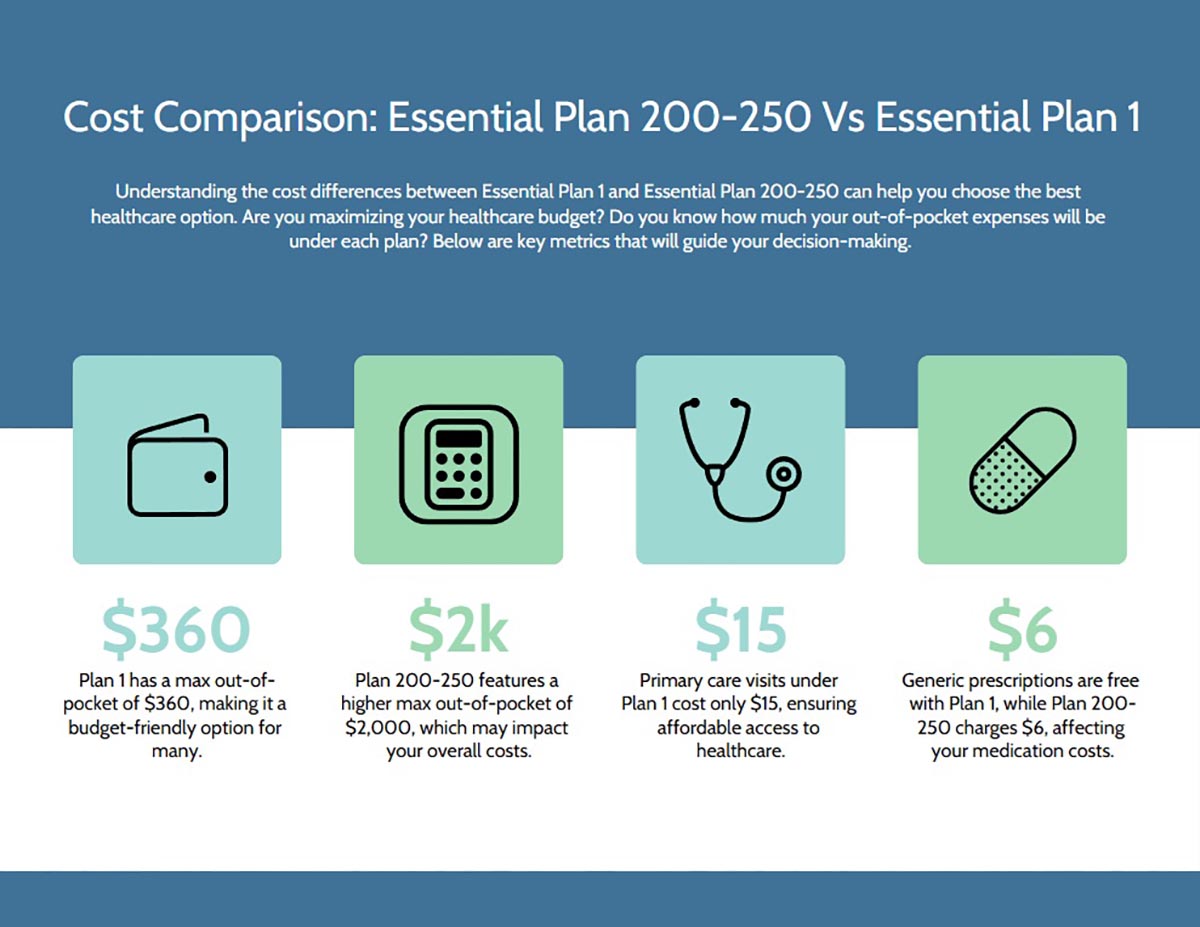

The primary difference between the plans is their out-of-pocket costs:

| Service | Essential Plan 1 Copay | Essential Plan 200-250 Copay |

|---|---|---|

| Max Out-of-Pocket (Annual) | $360 | $2000 |

| Primary Care Visit | $15 | $15 |

| Specialist Visit | $25 | $25 |

| Emergency Room | $75 | $75 |

| MRI | $25 | $25 |

| Prescriptions (Generic) | $0 | $6 |

Essential Plan 1 is more cost-effective for frequent healthcare users, while Essential Plan 200-250 suits those with higher incomes who may need less care.

Cost comparison chart for Essential Plan 200-250 vs Essential Plan 1

Benefits: What’s Covered by Both Plans?

Both plans offer identical core benefits with $0 premiums and no deductibles:

- Medical Care: Doctor visits, hospital stays, emergency care, preventive services (e.g., free flu shots).

- Dental Care: Cleanings (twice a year), exams, X-rays, fillings.

- Vision Care: Annual eye exams, glasses or contacts (up to $100 allowance).

- Prescriptions: Generic and brand-name medications (copays vary).

Some insurers like UnitedHealthcare offer extras like gym reimbursements, while Healthfirst provides 24/7 telehealth. Check with our brokers for insurer-specific perks.

Scenarios: Which Plan Fits Your Situation?

Here are examples to help you decide:

- Scenario 1: Single Person in NYC – Alex earns $28,000 annually. They qualify for Essential Plan 1, benefiting from a lower max out-of-pocket ($360 vs $2,000).

- Scenario 2: Family of Three in Buffalo – The Smiths earn $60,000. They qualify for Essential Plan 200-250, as their income is above 200% FPL for their household size.

Member Stories: Experiences with Both Plans

Emma’s Story: Essential Plan 1 in Albany

Emma, a 35-year-old freelancer earning $25,000, chose Essential Plan 1. “The $360 max out-of-pocket is affordable, and I love the free dental cleanings,” she says.

Mike’s Story: Essential Plan 200-250 in Queens

Mike, a 40-year-old earning $36,000, enrolled in Essential Plan 200-250. “I don’t use healthcare often, so the higher max out-of-pocket isn’t an issue, and I still get free coverage,” he shares.

How to Enroll in Either Plan

Enrolling through nyhealthinsurer.com is simple:

- Check Eligibility: Confirm your income and other requirements with our brokers.

- Compare Plans: Review Essential Plan 1 and 200-250 with our guidance.

- Select a Plan: Choose the best option for your needs.

- Complete Enrollment: Finalize your application with our support.

Enrollment is open year-round. Contact our team to get started.

Frequently Asked Questions

What’s the main difference between Essential Plan 200-250 and Essential Plan 1?

The main difference is income eligibility (150%–200% FPL for Plan 1, 200%–250% FPL for 200-250) and max out-of-pocket costs ($360 for Plan 1, $2,000 for 200-250).

Are the benefits the same for both plans?

Yes, both offer medical, dental, vision, and prescription coverage with $0 premiums and no deductibles, though copays differ.

Can I switch between Essential Plan 1 and 200-250 if my income changes?

Yes, if your income changes, you can update your plan through the NY State of Health marketplace. Contact our brokers for assistance.

Which plan is better if I use healthcare frequently?

Essential Plan 1 is better for frequent healthcare users due to its lower max out-of-pocket cost ($360 vs $2,000).

How do I enroll in either plan?

Contact our brokers at nyhealthinsurer.com to check eligibility, compare plans, and enroll.

Call (888) 215-4045 or visit nyhealthinsurer.com for more information.