Healthy NY Eligibility Guide for Employers

If you’re a small business owner in New York State, the Healthy NY program may offer you an affordable way to insure your team. This guide breaks down the 2025 eligibility rules in detail — from wage limits to documentation — so you can determine if your business qualifies.

Who Can Apply?

To be eligible for Healthy NY in 2025, your business must meet all of the following requirements:

- Your business is physically located in New York State

- You employ between 1 and 50 full-time equivalent (FTE) employees

- At least 30% of your employees earn $53,650 or less annually

- You have not provided comprehensive group health insurance within the past 12 months

- You agree to contribute at least 50% of the monthly premium for enrolled employees

Note: These rules apply to active, operational small businesses, not individuals or sole proprietors.

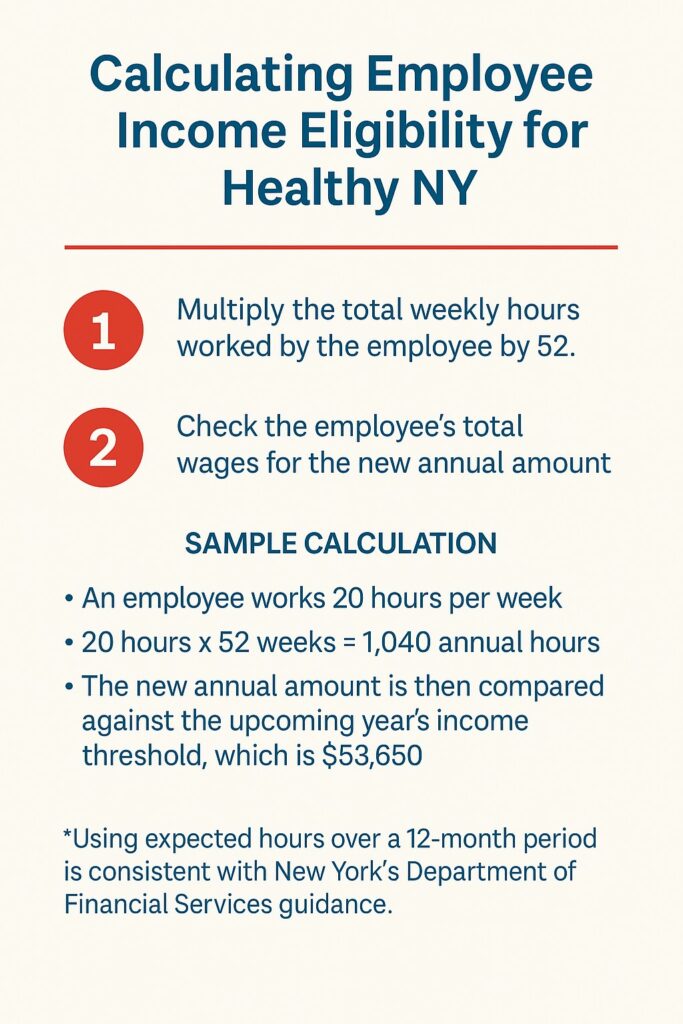

Understanding the Wage Threshold

The wage requirement is often the most confusing part of eligibility. For 2025, the threshold is $53,650 or less in annual wages.

- Wages refer to base annual pay, not including overtime or bonuses

- You must document that at least 30% of your employees fall below this threshold

- Use your most recent payroll data or wage reports for verification

What If You Recently Offered Insurance?

Businesses that offered group coverage within the past 12 months are generally ineligible — however, there are a few exceptions:

- If your previous plan was canceled due to insurer withdrawal or price increase

- If you are a newly registered business

You may be asked to provide documentation explaining why coverage lapsed or ended.

Documents You’ll Need

Be prepared to provide the following during your application:

- Proof of New York State business address

- Employee census with job roles and salaries

- Wage and payroll documentation

- Federal Employer Identification Number (EIN)

Real-World Examples

✅ Qualifies: A Brooklyn-based cleaning company employs 12 workers, 8 of whom earn under $52,000 annually. The business has not offered health insurance in 18 months and is willing to contribute 50% of the premium. This employer qualifies.

❌ Doesn’t Qualify: A midtown Manhattan consulting firm with 8 employees earning $80,000+ annually does not meet the income threshold and is ineligible for Healthy NY.

What’s Next?

If your business meets the eligibility criteria, you can move forward with selecting a Healthy NY plan. Visit our Healthy NY pillar page to explore coverage options, benefits, and how to apply.

Still not sure if your business qualifies? Call (888) 215-4045 to speak with a licensed NY Health Insurer agent, or start your quote online.