Why Health Insurance Premiums Increase in New York

Jun 25th, 2025

Health insurance premiums in New York often leave individuals and small businesses asking the same question: Why do my rates keep going up? The answer lies in a combination of market forces, state regulations, and healthcare cost trends. This guide explains the most important factors that drive rate increases and what you can do to manage costs.

Community Rating and Risk Pooling

New York uses a community rating system, which means insurers must offer the same premium to everyone in a geographic area regardless of health status. While this promotes fairness, it also means healthy individuals may pay more to balance out the risk of covering high-cost enrollees. The larger and more diverse the insurance pool, the more stable the rates—but adverse selection can drive costs up when healthier people opt out.

Medical Inflation and Technology Costs

Medical care costs rise every year due to:

- New (often expensive) diagnostic and treatment technologies

- Rising hospital and provider fees

- Higher prices for brand-name and specialty prescription drugs

These trends impact what insurers must pay out—and in turn, they pass those costs onto policyholders through higher premiums.

Changes in Benefits and Mandated Coverage

New York mandates certain essential health benefits and consumer protections beyond federal ACA requirements. For example:

- Expanded mental health and substance abuse coverage

- No-cost preventive services

- Gender-affirming care requirements

Each new mandate increases what insurers must cover, which often translates into higher premiums for everyone.

Demographic Factors and Age Bands

Premiums are also influenced by who is enrolling:

- Older adults naturally use more healthcare services

- High-utilization groups (e.g., people with chronic conditions) raise average claim costs

- In the individual and small group markets, age-banded pricing allows higher rates for older enrollees, but they are still community-rated within limits in NY.

Regional Pricing and Plan Type

Where you live matters:

- Urban areas like NYC often have higher provider and hospital charges

- Rural areas may lack competition, raising prices

- PPO plans cost more than HMO plans due to their broader networks and out-of-network coverage

Annual Rate Filings and DFS Review

Each year, insurers in New York submit premium rate filings to the Department of Financial Services (DFS). DFS can approve, reduce, or reject requested increases based on claims data, administrative costs, and market trends.

📄 To understand how that process works, see our detailed breakdown:

👉 Understanding NY Health Insurance Rate Increase Applications (2025)

What You Can Do to Manage Costs

- Shop around during open enrollment (or use a broker for free help)

- Consider changing metal tiers (e.g., Silver → Bronze)

- Use tax credits or programs like the Essential Plan if eligible

- Choose telemedicine and preventive care options when possible

Tips from Brokers: How to Avoid Unnecessary Increases

- Annual Plan Review: Don’t auto-renew. Plan designs and rates change—what worked last year may not be ideal now.

- Network Optimization: Choose plans that include your preferred doctors and hospitals but avoid unnecessary out-of-network exposure.

- Right-Size Your Coverage: Avoid overbuying. Bronze or Silver tiers might meet your needs better than Gold.

- Evaluate Eligibility for Subsidies: Especially through the NY State of Health marketplace or public programs like the Essential Plan.

Historical Trends in NY Premium Increases

Over the past decade, New York has seen annual premium increases ranging from 4% to over 9%, depending on market conditions and insurer filings. According to the NY Department of Financial Services:

- In 2023, DFS approved average increases of 9.3% in the individual market and 7.4% in the small group market.

- In 2022, approved increases averaged 9.7% for individuals and 7.6% for small groups.

While these numbers fluctuate year to year, the trend underscores the importance of reviewing your plan options annually.

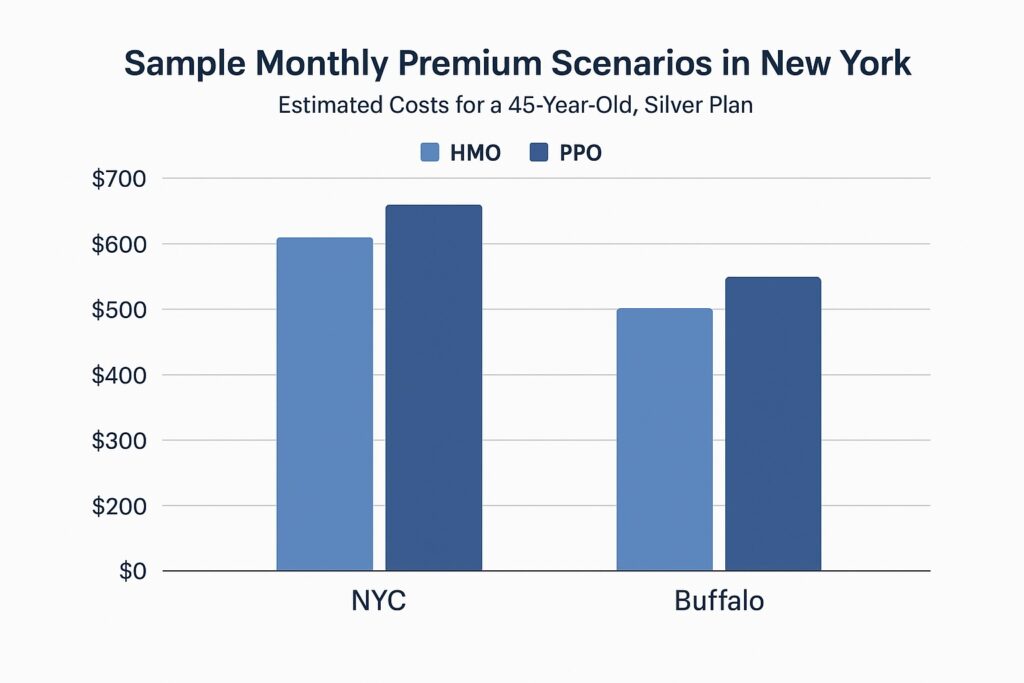

Sample Monthly Premium Scenarios in New York

While exact rates depend on age, region, and plan type, here are a few estimated ranges based on 2025 market data:

- A 40-year-old in New York City:

– HMO Bronze Plan: $480–$530/month

– PPO Silver Plan: $620–$700/month - A self-employed individual in Buffalo:

– HMO Silver Plan: $430–$500/month

– PPO Gold Plan: $680–$750/month

Frequently Asked Questions

What causes health insurance premiums to increase in New York?

Does age affect how much I pay for health insurance?

Can New York deny a health insurance rate increase request?

How can I reduce my monthly health insurance costs?

Final Thoughts

Premiums increase for complex reasons—but understanding these drivers can help you make smarter choices. If you need help finding a more affordable plan, our licensed brokers are here to help.

📞 Call us at 888-215-4045 or start your quote online.

Related posts from our blog:

Tags: