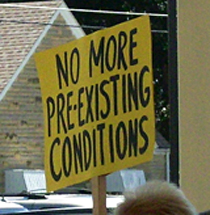

Pre-Existing Conditions

Nov 15th, 2010

Individuals suffering and living with pre-existing medical health care conditions have a difficult time with health insurance coverage. Those individuals who have been enrolled with a reputable health insurance provider fare much better than any individual in search of health insurance coverage does.

Individuals suffering and living with pre-existing medical health care conditions have a difficult time with health insurance coverage. Those individuals who have been enrolled with a reputable health insurance provider fare much better than any individual in search of health insurance coverage does.

This applies to adults and for their children. Most adults who are involved in the employment world stand a much better opportunity to acquire affordable health insurance coverage through a group plan with their place of employment. Other individuals will have to do some research and they must also expect to be hit with a waiting period of up to eighteen months.

The best place to begin your search is with the various health insurance providers who all have information that you can reach via the telephone and internet. Pre-existing conditions as defined by most health insurance providers is a chronic condition that existed and you have been treated for in the prior six months.

Some pre-existing conditions are life long and that can be a problem when searching for a new health insurance provider. A few of the more known pre-existing conditions that the health insurance industry watches for are:

1. Pregnancy, obesity, and diabetes

2. Arthritis, depression, and fibromyalgia

3. Asthma, Thyroid disease, and high blood pressure

4. Cancer, back difficulties, and Lupus disease

5. High cholesterol, and acne

The health insurance providers acknowledge some pre-existing conditions develop into major illness and some remain as minor incidents. Most individuals have something that falls into the pre-existing health care issue but this is a way for the health insurance providers to maintain the healthier individuals while carefully screening those individuals who require regular medical health care assistance.

The health insurance providers need to learn how to understand that when individuals like themselves become unemployed it becomes very difficult to maintain even a low cost health insurance policy. There are other issues that take top priority such as meeting mortgage payments, paying rent, finding a way to put food on the table and even this can become difficult.

There are two ways for the health insurance provider to handle the minor pre-existing conditions. This is through a rate up or an addendum rider to the current health insurance policy. A rate up means an additional fee added to the original health insurance quotes, while the rider is an addendum that is added to the health insurance policy with a twelve month, eighteen month, or twenty-four month waiting period for the specific pre-existing condition.

Related posts from our blog:

No related posts.

Tags: arthritis | Asthma | cancer | diabetes | health care | health insurance providers | News | obesity | pre-existing conditions | pregnancy