NY State of Health: Affordable Health Insurance Marketplace

NY State of Health (NYSOH) offers affordable health insurance plans for all New Yorkers, ensuring access to quality care across the state. Whether you’re an individual, a family, or a small business owner, NYSOH provides a range of programs tailored to your needs, including Qualified Health Plans (QHPs), the Essential Plan, Medicaid, and Child Health Plus. As of 2025, over 6 million New Yorkers are enrolled in NYSOH programs, making it a cornerstone of the state’s healthcare system (governor.ny.gov). At NY Health Insurer, our licensed brokers simplify the enrollment process, helping you find the best plan for your budget and healthcare needs—call (888) 215-4045 for a free quote.

What Is the NY State of Health Marketplace?

NY State of Health (NYSOH) is New York’s official health insurance marketplace, established in 2013 under the Affordable Care Act (ACA). It serves as a centralized platform where New York residents can compare, enroll in, and manage health insurance plans that meet their needs and budgets. NYSOH offers a variety of programs, including Qualified Health Plans (QHPs), the Essential Plan, Medicaid, and Child Health Plus, each designed to cater to different income levels, age groups, and healthcare requirements.

As of 2025, NYSOH has enrolled over 6 million New Yorkers, with 1.5 million in the Essential Plan alone, according to governor.ny.gov. The marketplace has been a lifeline for many, providing access to subsidies, cost-sharing reductions, and essential health benefits like doctor visits, hospital care, prescriptions, and preventive services. In 2025, NYSOH expanded telehealth services through a collaboration with the Office of Mental Health (OMH), introducing telepsychiatry initiatives to improve mental health access across the state (pmc.ncbi.nlm.nih.gov). This expansion ensures that New Yorkers, regardless of location, can access care conveniently.

NY Health Insurer has been a trusted partner since 2013, helping thousands of families navigate NYSOH’s offerings. Our licensed brokers provide personalized support, offering instant quotes, plan comparisons, and eligibility checks to ensure you find the right coverage. Whether you’re in New York City, the Finger Lakes, or the North Country, we’re here to help you enroll in a plan that fits your lifestyle. Explore specific programs: Qualified Health Plans, Essential Plan, Child Health Plus, or NYC-specific plans.

Why Choose NY Health Insurer for NYSOH?

Navigating health insurance can be overwhelming, but NY Health Insurer makes enrolling in NYSOH plans seamless and stress-free. Here’s why thousands of New Yorkers trust us to guide them through the process:

- Certified Brokers with Expertise: Our team is trained to navigate NYSOH’s enrollment process, ensuring you understand your options and choose the best plan for your needs. We handle the paperwork, answer your questions, and provide step-by-step guidance.

- Instant Quotes Tailored to You: Using our advanced quoting tool, we compare plans in real-time, factoring in your zip code, income, and healthcare preferences to find the most cost-effective options.

- Provider Verification for Peace of Mind: Before you enroll, we confirm that your preferred doctors, specialists, and hospitals are in-network, so you can access care without unexpected costs.

- Multilingual Support for NYC’s Diversity: We offer assistance in multiple languages, including Spanish, Mandarin, and Russian, to serve New York City’s diverse communities and ensure everyone can access coverage.

- Trusted Since 2013 with Proven Results: Over the past decade, we’ve helped thousands of families enroll in NYSOH plans with no hidden fees, saving them millions in healthcare costs.

- Free, No-Obligation Consultations: Our services are completely free, and there’s no obligation to enroll. We’re here to help you make an informed decision without pressure.

For example, a Brooklyn family we assisted in 2024 enrolled in a Qualified Health Plan, saving $2,000 annually with subsidies. Another client in Syracuse enrolled their children in Child Health Plus, accessing free dental and vision care through Fidelis Care. These success stories highlight our commitment to helping New Yorkers find affordable, quality coverage.

Ready to explore your options? Our quoting tool makes it easy to compare plans and check eligibility in minutes, keeping you on our platform for a seamless experience. Whether you’re looking for a QHP, the Essential Plan, or Child Health Plus, we’ll guide you every step of the way.

Explore NYSOH Programs

NYSOH offers four main programs to meet the diverse needs of New York residents. Each program is designed to provide affordable, comprehensive coverage, ensuring that everyone—regardless of income, age, or health status—has access to the care they need. Here’s an in-depth look at each program:

Qualified Health Plans (QHPs)

Qualified Health Plans (QHPs) are private health insurance plans that meet ACA standards, offering a range of coverage levels through Bronze, Silver, Gold, and Platinum tiers. These plans are ideal for individuals and families who need flexibility in choosing providers and are willing to pay premiums that vary based on the tier selected. QHPs cover essential health benefits, including hospital stays, doctor visits, prescriptions, mental health services, maternity care, and preventive care like annual checkups and vaccinations.

In 2025, nearly 195,000 New Yorkers are enrolled in QHPs through NYSOH, with many benefiting from premium tax credits and cost-sharing reductions. However, recent federal funding cuts announced on March 27, 2025, may impact subsidy amounts, potentially increasing out-of-pocket costs for some enrollees (governor.ny.gov). Despite these challenges, QHPs remain a popular choice for those seeking comprehensive coverage with a wide network of providers. Learn more about QHPs.

Essential Plan

The Essential Plan is a state-sponsored program for low-income adults who don’t qualify for Medicaid but need affordable coverage. It offers comprehensive benefits with $0 premiums for incomes 138% of the Federal Poverty Level (FPL) up to 250% FPL. As of 2025, the Essential Plan covers 1.5 million New Yorkers, making it one of NYSOH’s most popular programs (governor.ny.gov). For detailed eligibility and benefits, visit our Essential Plan page.

Medicaid

Medicaid provides free health insurance to very low-income New Yorkers, with eligibility typically up to 138% FPL (e.g., $20,784 for a single adult in 2025). It covers a wide range of services, including doctor visits, hospital care, prescriptions, and limited dental and vision care. Medicaid is ideal for individuals and families with limited financial resources, offering comprehensive coverage with minimal or no out-of-pocket costs.

In 2025, Medicaid continues to be a cornerstone of NYSOH, serving millions of New Yorkers. Recent expansions in telehealth, particularly for mental health services through OMH telepsychiatry initiatives, have made it easier for Medicaid enrollees to access care remotely (pmc.ncbi.nlm.nih.gov). NY Health Insurer can help determine if you qualify for Medicaid and assist with enrollment.

Child Health Plus

Child Health Plus is a low-cost or free health insurance program for children under 19, with eligibility up to 400% FPL (e.g., $124,800 for a family of 4 in 2025). It offers comprehensive coverage, including medical, dental, vision, prescriptions, and mental health services, with premiums ranging from $0 to $60/month based on income. In 2025, over 400,000 New York children are enrolled, benefiting from expanded mental health support through OMH initiatives (governor.ny.gov).

Child Health Plus ensures that kids across New York have access to the care they need to grow and thrive, from well-child checkups to therapy sessions. Families in NYC and Upstate alike can rely on NY Health Insurer to enroll their children in this program. Discover Child Health Plus.

| Program | Eligibility | Cost | Best For |

|---|---|---|---|

| QHPs | No income limit | Varies, subsidies available | Flexible provider needs |

| Essential Plan | 138%–250% FPL | $0/month | Low-income adults |

| Medicaid | Up to 138% FPL | $0 | Very low-income |

| Child Health Plus | Up to 400% FPL | $0–$60/month | Children under 19 |

Financial Assistance and Subsidies

NYSOH offers financial assistance to make health insurance affordable for New Yorkers at various income levels. These subsidies help reduce premiums, deductibles, and out-of-pocket costs, ensuring that coverage is accessible to all. Here’s a breakdown of the financial assistance available through NYSOH in 2025:

- Premium Tax Credits for QHPs: Available to individuals and families with incomes between 100% and 400% FPL (e.g., $37,650-$60,240 for a single adult). These credits lower monthly premiums, making QHPs more affordable. In 2025, the average tax credit is $450/month per household, though recent federal funding cuts may reduce this amount (governor.ny.gov, March 27, 2025).

- Cost-Sharing Reductions (CSRs): For QHP enrollees with incomes up to 400% FPL (e.g., $60,240 for a single adult), CSRs lower deductibles, copays, and out-of-pocket maximums, particularly for Silver plans. This ensures that low-income enrollees can access care without a financial burden.

- Essential Plan Subsidies: The Essential Plan offers $0 premiums for incomes 138% of the Federal Poverty Level (FPL) up to 250% FPL, with no deductibles and low copays, making it one of the most affordable options for eligible adults.

- Medicaid and Child Health Plus: Both programs are free or low-cost for eligible enrollees, with Medicaid covering those up to 138% FPL and Child Health Plus up to 400% FPL. Premiums for Child Health Plus range from $0 to $60/month per child based on income.

NY Health Insurer’s quoting tool calculates your eligibility for these subsidies instantly, ensuring you get the maximum financial assistance available. For example, a family of four in Albany we helped in 2024 qualified for a $600/month premium tax credit on a Silver QHP, saving them $7,200 annually. Another client in the Bronx enrolled in the Essential Plan for $0 premiums, accessing free dental and vision care. These savings demonstrate the value of NYSOH’s financial assistance programs.

However, it’s important to note that federal funding cuts announced on March 27, 2025, may impact subsidy amounts, potentially increasing costs for some QHP enrollees (governor.ny.gov). Our brokers stay updated on these changes, ensuring you’re informed about your options and can plan accordingly.

How to Enroll in NYSOH Plans

Enrolling in NY State of Health plans with NY Health Insurer is a straightforward process designed to keep you on our platform for a seamless experience. Here’s a step-by-step guide to getting covered:

- Enter Your Zip Code: Start by entering your zip code into our quoting tool to view plans available in your area, whether you’re in Manhattan, Syracuse, or Buffalo.

- Provide Your Details: Input your income, household size, and healthcare preferences. This helps us filter programs like QHPs, the Essential Plan, or Child Health Plus that best suit your needs.

- Check Eligibility: Our brokers verify your eligibility for NYSOH programs and subsidies, ensuring you qualify for the right plan and maximize financial assistance.

- Compare Plans: Review plan options side-by-side, comparing costs, benefits, and provider networks. We include real-time subsidy estimates to show your true out-of-pocket expenses.

- Apply Securely: Complete your application through our encrypted portal, with our brokers guiding you every step of the way to ensure accuracy and compliance.

- Renew Annually: We’ll send reminders to update your plan by December 15 each year, ensuring continuous coverage starting January 1. For 2025, renewals include new telehealth options for mental health support (pmc.ncbi.nlm.nih.gov).

A Manhattan family we assisted in 2024 enrolled in a QHP in just 15 minutes, verifying coverage at Mount Sinai. Another client in Rochester enrolled their child in Child Health Plus mid-year after a job change, saving $1,200 annually. Our process is designed to be quick, secure, and tailored to your needs, whether you’re in NYC or Upstate.

For more detailed enrollment guidance, visit our step-by-step enrollment guide.

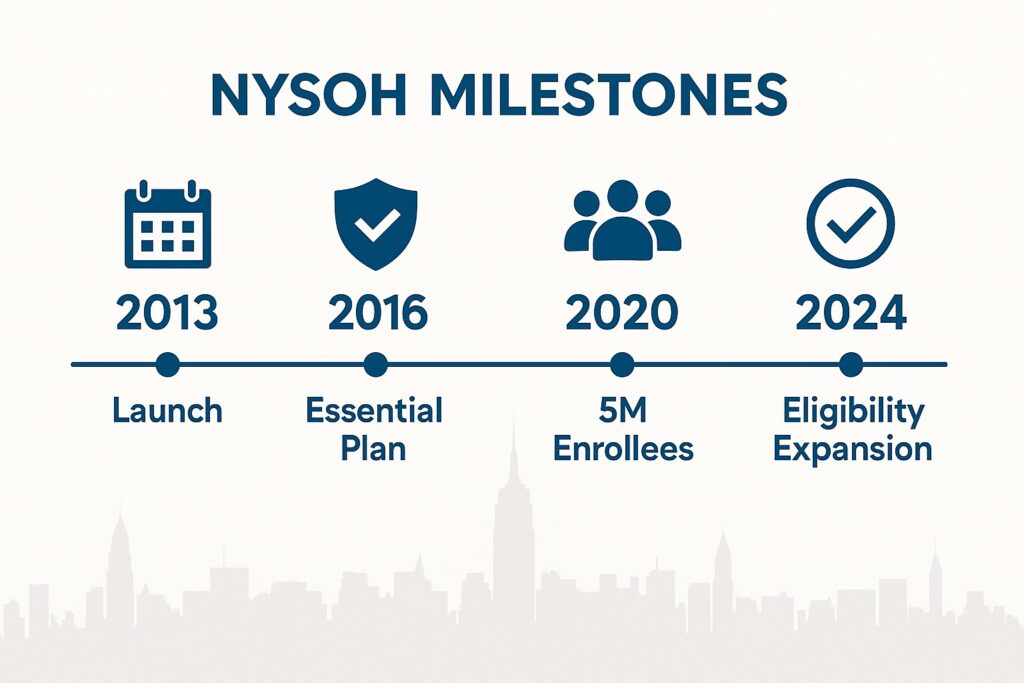

NYSOH Timeline

The NY State of Health marketplace has grown significantly since its inception, achieving key milestones that have expanded access to healthcare for millions of New Yorkers. Here’s a look at its journey:

From its launch in 2013 to the 2025 telehealth expansions, NYSOH continues to evolve, ensuring New Yorkers have access to affordable, quality care. These milestones reflect the state’s commitment to healthcare accessibility, even amidst challenges like recent federal funding cuts (governor.ny.gov, March 27, 2025).

Explore NYSOH Insurers

NYSOH partners with a wide range of trusted insurers to offer diverse plans across the state, ensuring that New Yorkers have access to quality care no matter where they live. These insurers provide a variety of benefits, including telehealth services, community wellness programs, and specialized care for children and adults. Here’s a look at some of the key providers available through NYSOH:

Providers like Healthfirst, Fidelis Care, UnitedHealthcare, MetroPlus, Excellus BlueCross BlueShield, and Independent Health offer plans tailored to different regions and needs. For example, Healthfirst provides robust telehealth services in NYC, while Fidelis Care offers community wellness programs in Upstate areas like Syracuse and Buffalo. In 2025, many of these insurers have expanded their telehealth offerings, particularly for mental health, aligning with NYSOH’s partnership with the Office of Mental Health (pmc.ncbi.nlm.nih.gov).

NY Health Insurer can help you compare plans from these providers, ensuring you find one that fits your healthcare needs and budget. Whether you’re in New York City or the North Country, we’ll verify provider networks to ensure your preferred doctors and hospitals are covered. Explore NYC-specific plans to learn more about urban-focused options.

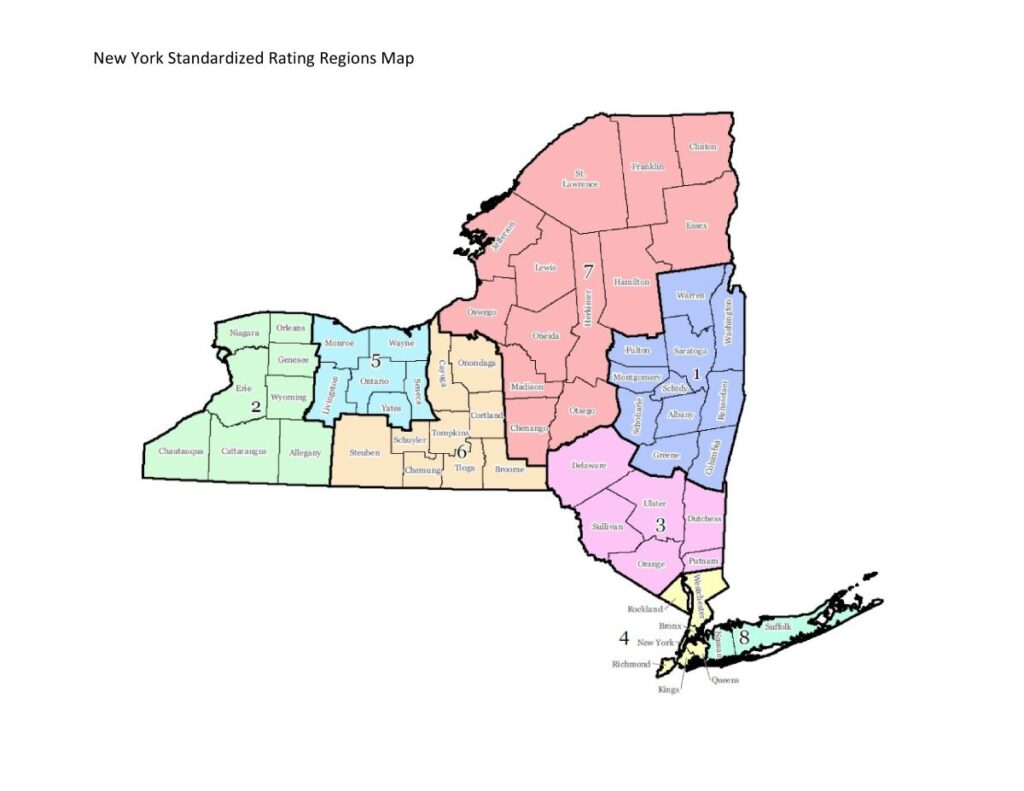

Regional Coverage Across New York

NYSOH ensures that health insurance plans are available across all regions of New York State, from the bustling streets of New York City to the rural landscapes of the North Country. Each region has unique healthcare needs, and NYSOH’s programs are designed to address them through tailored plans and provider networks. Here’s how NYSOH serves different parts of the state:

- New York City (NYC): Includes Manhattan, Brooklyn, Queens, the Bronx, and Staten Island. NYC residents benefit from urban-focused plans with providers like MetroPlusHealth and Healthfirst, offering telehealth and access to NYC Health + Hospitals. In 2025, telehealth services have expanded, particularly for mental health, making care more accessible for busy city dwellers (nyc.gov).

- Long Island: Covers Nassau and Suffolk Counties, with plans from Healthfirst and Fidelis Care that include suburban hospital networks like Northwell Health. A Nassau County family we helped in 2024 enrolled in a QHP, saving $1,500 annually with vision coverage included.

- Mid-Hudson: Includes Westchester, Putnam, and surrounding counties, with plans offering access to regional hospitals and telehealth for mental health support. A Westchester resident enrolled in the Essential Plan, accessing free dental care through Fidelis Care.

- Capital Region: Centered around Albany, with plans from providers like CDPHP offering community wellness programs. An Albany family saved $2,000 with a QHP in 2024.

- North Country: Covers the Adirondacks, with rural-focused plans providing access to community health centers. A North Country resident enrolled in Medicaid, benefiting from telepsychiatry services (pmc.ncbi.nlm.nih.gov).

- Mohawk Valley: Includes Utica, with plans from Excellus BlueCross BlueShield offering local clinic access. A Utica family enrolled their child in Child Health Plus, saving $1,200 annually.

- Central New York: Centered on Syracuse, with plans from Fidelis Care providing diabetes management resources. A Syracuse resident enrolled in the Essential Plan, saving $1,500.

- Southern Tier: Includes Binghamton, with plans offering preventive screenings in rural areas. A Binghamton family enrolled in a QHP with subsidies.

- Western New York: Covers Buffalo, with plans from Independent Health offering telehealth. A Buffalo resident enrolled in the Essential Plan, accessing free vision care.

- Finger Lakes: Includes Rochester, with plans from Excellus BlueCross BlueShield offering wellness programs. A Rochester family enrolled in Child Health Plus, saving $1,000.

NYSOH’s statewide coverage ensures that no matter where you live, you can access affordable, quality healthcare. NY Health Insurer tailors plan options to your region, verifying providers to meet your local needs.

Compare healthcare access in NYC, Long Island, and Upstate NY to understand how provider availability, wait times, and plan networks can differ by region.

Member Stories: Real New Yorkers, Real Impact

The impact of NY State of Health programs is best seen through the stories of real New Yorkers who have benefited from affordable coverage. Here are a few examples of how NYSOH and NY Health Insurer have made a difference:

Jennifer’s Story: Brooklyn Mother

Jennifer, a 38-year-old single mother from Brooklyn, enrolled her two children in Child Health Plus through NY Health Insurer in 2024. With a household income just above the Medicaid threshold, she qualified for $0 premiums, saving $1,800 annually. Her children now receive regular checkups, dental cleanings, and vision care through Healthfirst, with access to telehealth for quick consultations. “The process was so easy,” Jennifer says, “and I feel secure knowing my kids are covered.”

Michael’s Story: Albany Small Business Owner

Michael, a 45-year-old small business owner in Albany, enrolled in a Silver QHP in 2024, qualifying for a $500/month premium tax credit. He saved $6,000 annually and now has access to his preferred specialists at Albany Medical Center. “NY Health Insurer helped me compare plans and verify my doctor was in-network,” he shares. “I couldn’t have done it without their support.”

Sofia’s Story: Syracuse Caregiver

Sofia, a 32-year-old caregiver in Syracuse, enrolled in the Essential Plan for $0 premiums in 2024. She accessed free dental care and telepsychiatry services through Fidelis Care, saving $2,400 annually. “The telehealth option has been a lifesaver,” Sofia says, “especially for managing my mental health without taking time off work.”

Carlos’s Story: Bronx Entrepreneur

Carlos, a 40-year-old entrepreneur in the Bronx, enrolled in the Essential Plan through MetroPlusHealth in 2024. With $0 premiums, he accessed care at NYC Health + Hospitals/Lincoln, saving $2,000. “Enrollment took just 20 minutes,” he notes, “and I now have peace of mind knowing I’m covered.”

These stories highlight the transformative impact of NYSOH programs across New York. Whether you’re in NYC or Upstate, NY Health Insurer is here to help you find the right plan and save on healthcare costs. Call (888) 215-4045 to become the next success story.

Frequently Asked Questions

What is NY State of Health?

NY State of Health (NYSOH) is New York’s official health insurance marketplace, offering programs like QHPs, the Essential Plan, Medicaid, and Child Health Plus.

Who can enroll in NYSOH plans?

New York residents of all income levels can enroll, with programs tailored for individuals, families, and children, including subsidies for eligible applicants.

What programs are available through NYSOH?

NYSOH offers Qualified Health Plans (QHPs), the Essential Plan, Medicaid, and Child Health Plus, each designed for different income levels and healthcare needs.

How do I know if I qualify for subsidies?

Subsidies are available based on income. QHP tax credits apply to incomes 250%–400% FPL, while the Essential Plan and Child Health Plus have specific income thresholds.

Can I enroll in NYSOH plans year-round?

The Essential Plan, Medicaid, and Child Health Plus offer year-round enrollment. QHPs have an open enrollment period (Nov 1–Jan 31) or special enrollment for qualifying events.

Does NYSOH offer telehealth services?

Yes, many NYSOH plans include telehealth, with expanded mental health services in 2025 via OMH telepsychiatry initiatives (pmc.ncbi.nlm.nih.gov).

Get Covered with NYSOH Today

Take the first step toward affordable health insurance with NY Health Insurer’s expert support. Whether you’re exploring QHPs, the Essential Plan, or Child Health Plus, we’ll help you find the right plan for your needs. Call (888) 215-4045 to begin.

Get a quote now to check your eligibility and explore your options.

For more information, call (888) 215-4045 or visit nyhealthinsurer.com.