Rate Hike: More Bad News for New York State Health Insurance Customers?

Jul 7th, 2014

New York Health insurance customers may be in for a bit of a sticker shock next year. That’s at least according to new filings from health insurance companies with the New York State Department of Financial Services, who are seeking approval for various rate increases next year.

The New York Post broke the story last week with much fanfare. According to the Post, multiple New York health insurance companies selling at the New York State of Health Insurance Exchange are hoping for double-digit rate increases in 2015. If approved these rate hikes have the potential to affect thousands of New Yorkers when open enrollment begins again later this year.

The numbers for New York State Health Insurance Consumers

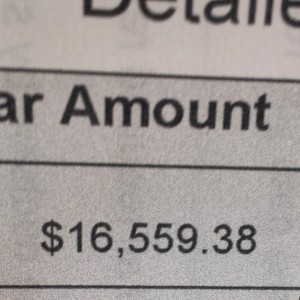

Among those companies selling health insurance exchange plans that are seeking increases are many of the state’s big providers. The currently more than 24,000 Excellus Health Plan customers could see a 19.7 percent increase in 2015. While MVP Health Plan is looking for a 19 percent boost for their 33,000 customers next year. New York State’s current largest health insurance exchange plan provider, Health Republic Insurance of New York, wants a 15.2 percent insurance for their 68,000 members. Aetna is also looking for a close to 20 percent hike.

Overall the average requested rate increase in New York State including both exchange and non-exchange offerings is 13 percent. This means that not every company is increasing rates, a few are decreasing them, and some that are looking for increases are only looking for modest ones.

Despite that, it’s still worth asking the question: Why are rates in New York State going back up so dramatically?

Why rate increases are (and still will be) the norm

Annual health insurance rate increases are pretty much the norm for customers in the United States. Each year health insurance companies assess how much more it will cost them in the coming year to continue offering their customers coverage. This projection is based on a few factors including the general cost of health care and the cost of regulation compliance.

Under the ACA it is more difficult for health insurance companies to implement rate increases that are more than 10 percent. If the company is going to increase rates by more than 10 percent it must first get approval from the state to do so and in the process justify why it is seeking the increase.

This was one way that officials planned to keep the promise of the end of huge annual health insurance rate hikes under the ACA. Doubly written into the law are regulations that put enormous pressure on health insurance companies to keep the cost of health insurance down.

However, at the same time that the government is asking health insurance companies to keep costs down, they’re mandating that they provide coverage for more health services. The result is that health insurance companies are being asked to do more (provide more services to risky groups of people), while not being able to charge more.

Because of this, health insurance companies feeling the financial squeeze have slashed network size for their New York State of Health Insurance plans, and cut doctor reimbursement rates. Exchange plan reimbursement rates are so bad in parts of New York State that many doctors with a choice are opting out of exchange plan networks. As you might expect this has created some dangerous coverage gaps in parts of the state.

This time last year in New York State

Last year New York State health insurance companies faced pressure from the state to keep their rates low for the first year of the New York State Health Insurance Exchange. Because of that pressure when the 2014 health insurance exchange plan prices were announced, state officials took great pleasure in mentioning that they were on average 53 percent cheaper than what was being offered the previous year in New York State.

Now ahead of the 2015 open enrollment season, those same officials are conspicuously silent as they contemplate the proposed rate increases. Of course, no single company is looking for a 53 percent increase, but with more than one company asking for a near 20 percent bump, the public should be concerned.

For the time being though the rate increase requests are being considered by the state. They’ll either be approved or denied based on whether the state believes the companies have an appropriate reason to ask for the increase. Companies have cited a combination of greater health insurance mandates from the ACA, increased hospital costs, and a greater number of sick patients seeking care as their reasons for the requested rate hikes.

Will this happen every year?

The answer here is likely yes. Yes, we’re going to see at least consistent minimal rate increases every year for New York State Health Insurance Exchange plans until something is actually done to address the underlying causes of the huge cost of healthcare in the United States.

Related posts from our blog:

No related posts.

Tags: health insurance | New York | new york state health insurance exchange | nyc

Posted in: Simon Bukai | Comments Off