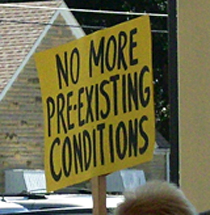

Dealing With Pre-Existing Medical Conditions

Feb 6th, 2012

People with pre-existing conditions generally have a more difficult time finding affordable health insurance.

People with pre-existing conditions generally have a more difficult time finding affordable health insurance.

“We’ve had this problem for a very long time: getting affordable health insurance is very difficult for those with pre-existing medical conditions. Though it is still possible, it can be quite a challenge. We’re hoping for a turnaround in 2014,” said Clelland Green, president and CEO of Benepath in Pennsylvania.

If health care reform goes according to plan, insurance providers can no longer exclude individuals with pre-existing conditions from getting coverage starting 2014. Unfortunately, two years is still a long way and the law can do nothing for the millions of Americans considered uninsurable today.

“To bridge the gap between today and the future, the government created Pre-Existing Condition Insurance Plan in all fifty states,” Green said. “In essence, the plan provides health insurance for those who have difficulties getting health insurance because of pre-existing conditions. The plan offers primary care, hospital care, specialty care, and prescription drugs. The plan is ideally suited for the 57 million individuals living without health insurance. However, there are currently less than 19,000 people who have taken advantage of this plan.”

In today’s fragile economy, it is safe to assume that uninsured individuals with pre-existing conditions would take advantage of the opportunity to get this reasonably priced health insurance. Unfortunately, while the plan may seem attractive, the hurdle is its long waiting period.

Those who want to switch to this plan must deal with living without any coverage for at least six months before they can apply. “Six months may be too long, especially for those who have conditions which require medications. Most feel that the risk is too big to take, even if they will end up paying less after the waiting period was over,” according to Green.

An option available for those having this dilemma is non-insurance health plans. These plans are typically offered to large groups of people. Members are given a huge deal of buying clout that allows them to purchase medical services at discounted prices.

Discount companies avail of better hospital deals by pre-negotiating cost reductions for hospital procedures or assigning an advocate to negotiate lower costs. “The advocate can also apply for financial assistance in order to pay for the balance on the member’s behalf, if applicable,” according to Green.

Generally, discount medical programs are very affordable, about $50 a month for the whole family. Many providers do not require contracts, and you can avail of the benefits upon signing up. “You must understand that this is not a traditional health insurance option,” added Green. “While it may not be for everybody, some may find it good enough to use as a temporary health insurance until they can get a regular one. In the end, the choice is yours and you should decide what you need to do for your health.”

Related posts from our blog:

No related posts.

Tags: affordable health insurance | inexpensive health insurance | pre-existing medical conditions

Posted in: Simon Bukai | Comments Off